Generative artificial intelligence (AI) and automation are expected to create more than $1 trillion in productivity gains worldwide by 2026. The real question is: will your finance workflow and team capture its share of that value?

Outdated workflows delay decisions, increase compliance risks, and drain time that should be spent on strategic priorities. Finance workflow automation fixes this by digitizing core processes, cutting costs, and delivering accuracy at scale.

Today, finance workflow automation is a must-have for firms that want to scale efficiently, reduce costs, and maintain accuracy in a demanding regulatory environment. So, how do you begin?

Key Takeaways

- Automation is no longer optional for finance teams

The blog highlights that manual, legacy finance workflows (e.g., spreadsheet-based, email chains) are no longer viable in 2025, given increasing regulatory pressure, global complexity, and the demand for real-time insights. - High-impact workflows to prioritize

Among the top 10 workflows recommended for automation are invoice approval, policy management, vendor/supplier onboarding, compliance & risk management, and accounts payable/receivable (AP/AR). - Tangible benefits of finance workflow automation

Automation delivers operational savings, improved accuracy, audit readiness, enhanced forecasting/planning, better liquidity visibility, reduced errors, and scalability during peak cycles. - Best-practice roadmap to success

The blog advises to: set clear measurable goals (e.g., reduced processing time, lower error rate); start with one high-impact workflow and scale; build a centre of excellence (CoE) for governance; train users; and track ROI via metrics such as time saved, cost reductions, and compliance improvements. - Automation technologies and triggers matter

Workflow automation in finance typically involves defined sequential steps (e.g., capture via OCR, rule-based routing, approvals), triggering actions, and minimal human intervention—thereby enabling faster execution and higher accuracy.

What is finance workflow automation?

Finance workflow automation uses technology, including artificial intelligence (AI) and robotic process automation (RPA), to execute predefined tasks within financial processes such as accounts payable, invoicing, or expense management. It streamlines operations, improves accuracy, ensures compliance, and allows finance teams to focus on strategic, value-added activities instead of repetitive manual work.

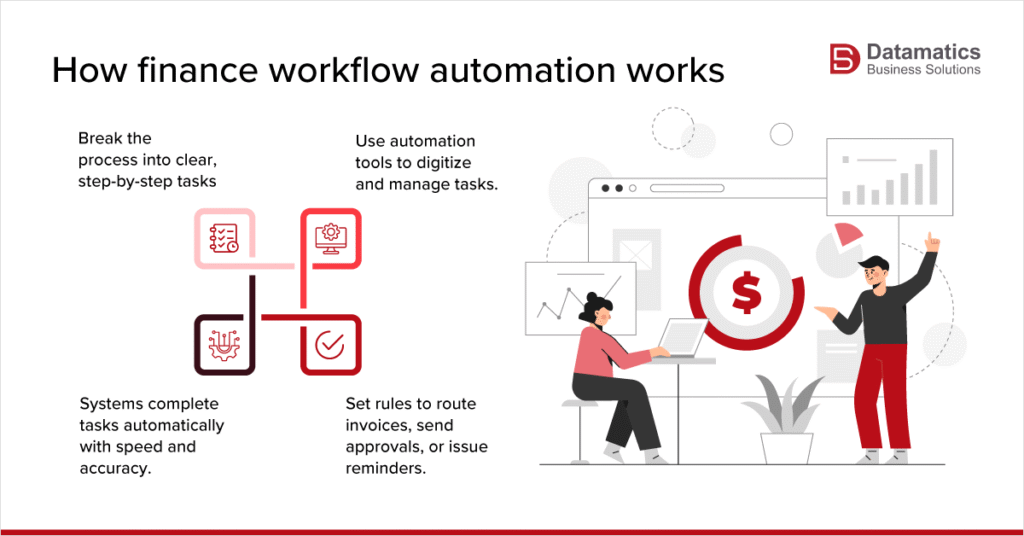

- Define the workflow: Break down a financial process, such as expense approvals, into clear, sequential steps.

- Implement the technology: Use automation software to digitize and manage these steps.

- Trigger actions: Apply rules that trigger actions, such as routing an invoice for approval or sending reminders.

- Execute tasks: The system performs tasks with minimal human intervention, replicating manual actions at higher speed and accuracy.

What makes finance workflow automation imperative in 2025?

Financial reporting automation removes manual data collection and report preparation. According to PwC, automating financial processes can save teams up to 40% of their time, giving firms a measurable competitive edge.

With rising regulatory pressure, global complexity, and demand for real-time insights, manual workflows are no longer viable.

Automation closes these gaps by cutting processing times, improving accuracy, and securing sensitive data, while AI-driven analytics enhance forecasting, audit readiness, and risk management.

10 key finance workflows and processes to automate in 2025

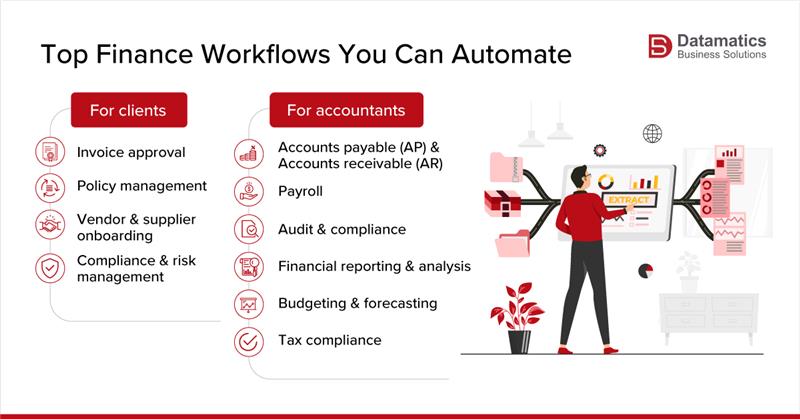

Not every finance workflow or process requires automation. However, focusing on areas with high compliance, efficiency, and client experience impact yields the greatest return.

1. Invoice approval

Manual invoice approvals often depend on emails or spreadsheets, leading to delays and errors. Automation captures invoices with OCR, matches them to purchase orders, and routes them to the right approver based on rules like department or spend threshold.

Approvers are notified instantly, and once approved, invoices move directly to payment. This reduces approval time from days to hours, prevents duplicate payments, and strengthens vendor relationships.

If you want to try invoicing automation without an upfront cost, try Free billing software to create sample invoices and test workflows.

2. Policy management

Policies are essential to compliance but often scattered across spreadsheets and documents. Automation centralizes policy management, ensures real-time access, and reduces time spent tracking updates.

3. Vendor and supplier onboarding

Onboarding inefficiencies can lead to delays and poor client experience. By automating onboarding steps such as document collection, approvals, record creation, etc., organizations accelerate cycle times and improve transparency.

4. Compliance and risk management

Finance teams operate in one of the most heavily regulated environments globally. Automating compliance-related workflows creates a digital audit trail, secures sensitive data, and ensures adherence to evolving frameworks such as SOX (Sarbanes–Oxley Act), the Health Insurance Portability and Accountability Act (HIPAA), and other US financial reporting and data protection regulations.

5. Accounts payable (AP) and accounts receivable (AR)

Only 5% of mid-sized firms have fully automated their Accounts Payable (AP) and Accounts Receivable (AR) processes. Automating AP processes enables invoice capture with OCR, automatic matching of invoices with purchase orders, digital approval routing, and payment scheduling. This reduces processing time, minimizes errors, and improves vendor relationships.

You can also read: Why Outsourced Accounting Still Matters in the Age of AI and Automation

6. Procure to pay (P2P)

Procure to Pay automation connects purchasing with accounts payable. Automated workflows generate purchase orders, match them with vendor invoices, and route approvals instantly. Exceptions such as mismatched quantities or prices are flagged automatically. Once approvals are cleared, payments are scheduled, ensuring accuracy, reducing delays, and strengthening vendor relationships.

7. Order to cash (O2C)

Order to Cash automation streamlines the cycle from order entry to payment collection. Systems validate sales orders, generate invoices, match payments against outstanding receivables, and send reminders for overdue accounts. This reduces manual follow-ups, accelerates cash flow, and improves client satisfaction.

8. Record to report

AI-enabled Record to Report automation consolidates data, reconciles ledgers, and generates month-end financials with speed and accuracy. It minimizes errors, ensures compliance-ready reporting, and delivers real-time insights for smarter forecasting and decision-making.

9. Budgeting and forecasting

Automation leverages predictive analytics and historical data to create dynamic budgets and forecasts. This supports strategic planning and helps organizations respond quickly to changing market conditions.

10. Tax compliance

Adoption of tax automation is no longer a question of if, but when. 94% of firms surveyed by Thompson Reuters feel hopeful or excited about the future of tax technology. Automated solutions already manage calculations, filings, and record-keeping with accuracy, ensuring compliance and reducing penalties.

What are the benefits of finance workflow automation?

The tangible benefits of finance workflow automation extend well beyond efficiency gains, as follows:

- Automation eliminates redundant tasks, allowing finance teams to focus on strategic initiatives.

- Standardized processes create reliable records and minimize compliance risks.

- Reduced manual labour and errors translate into significant operational savings.

- Digital workflows generate structured data that supports better forecasting, planning, and reporting.

- Automated processes scale easily during peak cycles such as tax season or year-end audits.

- Human error is minimized in core functions like AP, AR, and payroll.

- Liquidity visibility and control improve through automated AR and expense systems.

- AI-enabled monitoring reduces the risk of fraud and financial misconduct.

- Dynamic forecasting and budgeting enable better-informed strategic decisions.

- Audit trails generated automatically simplify both internal and external reviews.

What are the best practices for finance automation success?

Organizations achieving the strongest ROI from finance automation follow structured best practices:

1. Set clear goals by defining measurable outcomes such as reduced processing time, lower error rates, or improved compliance.

Clear objectives help prioritize processes for automation and provide benchmarks to track progress.

2. Start small and scale fast by automating one high-impact finance workflow first.

Proving quick wins builds confidence among stakeholders, encourages adoption, and creates a roadmap for expanding automation across other processes.

3. Build a centre of excellence to oversee governance, maintain consistency, and ensure best practices are followed.

A dedicated team provides structure and accountability, while driving continuous improvement in automation initiatives.

4. Train users effectively to promote adoption and maximize value.

Even the best automation tools fail if users are not comfortable with them. Regular training, clear documentation, and ongoing support improve user confidence and increase system utilization.

5. Measure ROI by tracking time saved, compliance improvements, and cost reductions.

Demonstrating tangible business value not only secures executive buy-in but also helps finance leaders refine automation strategies and allocate resources more effectively.

Conclusion

Finance workflow automation is now a critical driver for firms aiming to boost efficiency, ensure compliance, and gain real-time visibility across their financial operations. To succeed, firms need the right partner with proven expertise in streamlining finance workflows.

FAQs

1. What exactly is finance workflow automation?

It refers to using technologies (like RPA, OCR, AI) to automate predefined tasks within finance processes—such as invoice capture, matching, routing, approvals—so that the finance team can move from manual task execution to strategic value-added work.

2. Why is finance workflow automation especially important in 2025?

Because pressures such as regulatory complexity, real-time stakeholder demands, global operations, and the need for accuracy and speed mean that manual workflows are increasingly a liability. Automation closes the gaps, delivering faster, more reliable, compliant operations.

3. Which finance workflows should I automate first for maximum impact?

The blog recommends starting with processes that are high-volume, error-prone, compliance-sensitive or involve vendor/supplier interaction. Examples include invoice approvals, AP/AR, vendor onboarding, policy management, compliance/risk processes.

4. What are the typical steps to implement automation in finance workflows?

Key steps: (a) define the workflow (map the steps); (b) implement technology (RPA, AI/OCR etc) to digitise; (c) set triggers (routing, escalation rules); (d) execute tasks with minimal human intervention; (e) monitor and optimise.

5. How do I measure success to ensure ROI from automation?

You should track measurable outcomes such as reduction in process times (e.g., days to hours), error rates, cost savings, compliance improvements, improved liquidity visibility, and scalability during peak periods. These metrics help build stakeholder buy-in and guide scaling.

Harsh Vardhan