Credit risk now demands direct attention from CFOs as payment cycles lengthen and capital costs rise. Organizations can no longer rely on informal judgment or reactive controls. A disciplined credit risk management program is essential for protecting liquidity, maintaining forecast accuracy, and ensuring consistent, risk-aligned decisions.

This guide outlines the core processes and practices CFOs need to manage credit exposure with precision and authority.

Understanding What Credit Risk Management Means

Credit risk management is the practice of identifying, assessing, and mitigating potential losses when a borrower or counterparty is unable to meet its financial obligations. In finance and accounting, the goal is simple: reduce exposure, maintain liquidity, and improve portfolio performance.

A strong program ensures that lending or trade credit decisions remain consistent and grounded in data. It also aligns the company’s financial risk mitigation strategies with its commercial priorities, supported by accurate credit risk analysis and reliable credit risk management solutions.

Key Takeaway

Effective credit risk management protects liquidity and ensures forecasts remain reliable by enforcing structured assessment, decision, documentation, and monitoring workflows.

The Credit Risk Management Process: How it Works

A robust credit risk management process is systematic and repeatable. It should cover policy, assessment, risk-based decision making, documentation, and monitoring.

1. Develop a clear credit policy

Set rules for lending decisions, credit limits, and acceptable risk levels. Define risk tolerance, target markets, standard terms, and escalation procedures.

2. Conduct a detailed credit assessment

Run a structured credit risk assessment that includes quantitative and qualitative checks. Review financial statements, credit history, cash flow stability, and market conditions. Evaluate customer concentration and industry risks, and ensure the assessment feeds into broader credit risk analysis frameworks.

3. Make a disciplined credit decision

Use the assessment findings to decide how much credit to extend and on what terms. Align interest rates, collateral requirements, and repayment timelines to the risk profile.

4. Strengthen credit administration and documentation

Ensure loan and credit agreements are complete, enforceable, and compliant. Clear documentation protects the business during disputes and supports audit readiness.

5. Monitor the borrower continuously

Set up ongoing credit risk monitoring to detect early warning signs. Track payment behaviour, compliance with covenants, cash flow movements, and external market developments.

6. Prepare for remediation and collections

Create structured steps for early intervention, restructuring, and recovery. Use defined reminders, negotiation protocols, and legal pathways to minimize loss and resolve overdue accounts quickly.

You can also read: The CFO’s Playbook for AI-Ready Finance Teams

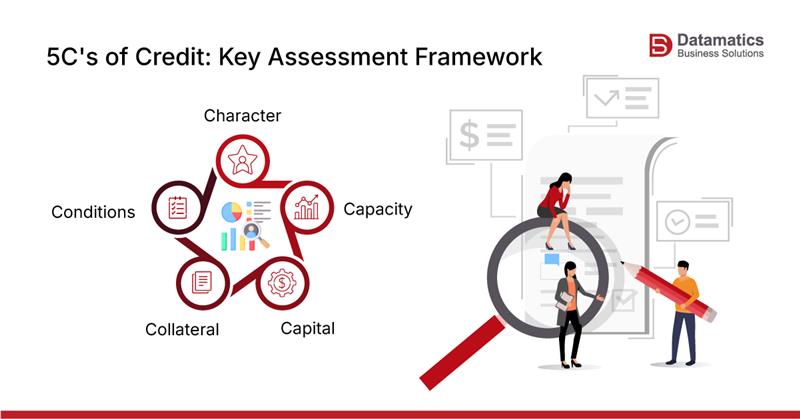

The 5 Cs of Credit and Why They Matter

The Five Cs of Credit give CFOs a clear, consistent framework for evaluating borrower quality. They help teams build stronger credit scoring models, improve portfolio risk analysis, and make lending or trade credit decisions that align with the organization’s risk tolerance. Here’s what it entails:

Character

Assesses the borrower’s reliability and repayment behaviour by reviewing credit reports, past delinquencies, dispute patterns, and financial discipline.

This matters because a borrower with poor payment behaviour increases operational effort, disrupts cash flow, and raises the likelihood of default.

Capacity

Measures the borrower’s ability to meet repayment obligations by analyzing cash flow, liquidity ratios, debt levels, and existing commitments.

This is crucial because even well-intentioned borrowers default if they lack the financial capacity to repay, and early signs of strain often appear in these metrics.

Capital

Evaluates how much the borrower has invested in the business or transaction.

This matters because higher internal investment signals commitment, lowers credit risk, and shows that the borrower is willing to share financial responsibility instead of shifting it fully to the lender.

Collateral

Identifies assets available to secure the exposure and improve recovery prospects if default occurs. This matters because secured credit significantly reduces potential loss and enables lenders to extend credit in situations where unsecured lending would be too risky.

Conditions

Considers macroeconomic trends, industry performance, competitive pressures, and regulatory factors. This matters because even a strong borrower can struggle if external conditions deteriorate, and forecasting these risks supports proactive credit exposure management.

Key Takeaway

The 5 Cs framework strengthens credit evaluation by aligning scoring models and portfolio analysis with the organization’s defined risk appetite.

6 Common Credit Risk Mitigation Strategies for Your Business

CFOs can reduce exposure using practical and proven measures that fit different business environments.

1. Diversification

Spread exposure across customers, sectors, and regions to avoid concentrations that could increase losses.

2. Risk-based pricing

Set pricing and interest rates based on borrower risk levels. Higher-risk accounts should bear higher costs to offset the probability of loss.

3. Collateral and guarantees

Use tangible assets or third-party guarantees to reduce unsecured exposure and enhance recoverability.

4. Stress testing

Simulate adverse market events to identify vulnerabilities within the loan or customer portfolio. Use results to adjust provisions, limits, and capital planning.

5. Credit insurance and derivatives

Transfer risk to third parties when managing high-value or strategic accounts.

6. Technology and analytics

Use automation, AI, and big data to strengthen credit scoring models, identify fraud patterns, and improve real-time credit risk monitoring.

Why CFOs Are Strengthening Their Credit Function Now

Economic uncertainty, tighter lending conditions, and higher capital costs are placing more pressure on credit decisions. Borrowers are taking longer to pay, access to cheap capital has reduced, and even small delays in receivables now have a direct impact on cash flow. These conditions are pushing CFOs to reinforce their credit function with stronger controls, better data, and continuous credit risk monitoring.

Strong credit risk management in finance improves liquidity by reducing late payments and lowering the volatility of cash inflows. A reinforced credit function also strengthens working capital, which is essential for funding operations, meeting payroll, and managing supplier commitments without relying on external borrowing. With interest rates higher than in previous years, optimizing working capital has become more cost-effective than securing additional credit lines.

You can also read: How CFOs Can Drive Growth in 2026 with Smart SaaS Accounting Outsourcing

Key Takeaway

Continuous monitoring, early-warning triggers, and remediation protocols reduce exposure and improve recovery outcomes across high-risk accounts.

How Outsourcing Helps with Credit Risk Operations

Many CFOs are turning to specialized finance and accounting partners to stabilize their credit function without expanding internal teams. Outsourcing adds structure, scale, and analytical depth to credit operations, which is difficult to maintain consistently in-house. The right partner strengthens both day-to-day execution and long-term risk control. Key advantages include:

- Stronger credit assessments are supported by trained analysts who run structured reviews, validate financial data, and apply consistent scoring criteria across all accounts.

- Improved monitoring discipline through automated tracking, risk alerts, and ongoing reviews that detect early signs of deterioration before they affect cash flow.

- Better documentation accuracy with dedicated teams who manage contracts, credit files, reconciliations, and compliance checkpoints.

- Faster remediation and collections driven by standardized follow-up cycles, escalation paths, and negotiated recovery strategies that reduce write-offs.

- Scalable operations that allow CFOs to increase credit reviews, portfolio checks, and reporting output without hiring, training, or managing additional staff.

Key Takeaway

Outsourcing credit operations adds analytical depth, consistency, and scalability that most internal teams cannot maintain sustainably.

Conclusion

Credit risk management is now a core responsibility for CFOs who want stable liquidity, accurate forecasts, and stronger working capital. CFOs who want to strengthen these processes without adding internal load can rely on partners like Datamatics Business Solutions for scalable, audit-ready credit operations that support disciplined risk-based decision making and long-term financial stability.

Contact our team to assess your current processes and identify where immediate improvements can be made.

FAQs

1. How can CFOs improve forecast accuracy through credit risk management?

Better credit assessments and continuous monitoring stabilize receivable inflows, reducing variance between projected and actual cash movements and improving short-term liquidity planning.

2. What signals should CFOs treat as early indicators of credit deterioration?

Declining payment discipline, covenant breaches, reduced cash flow, industry downgrades, and changes in leverage or working capital trends are strong indicators requiring immediate review.

3. When should CFOs consider outsourcing parts of the credit risk function?

Outsourcing becomes valuable when assessment volumes rise, internal review quality becomes inconsistent, portfolio complexity increases, or monitoring requires automation and specialized analytical support.

4. Does outsourcing finance increase operational or compliance risk?

Outsourcing itself does not increase risk if done correctly. Risks arise from poor readiness, weak governance, and lack of oversight. With defined controls, SLAs, audit rights, and compliance alignment, FAO can actually reduce risk.

Ashish Gupta