For many finance teams, the procure-to-pay (P2P) process is where efficiency often breaks down. What seems simple on paper—request, approve, pay—quickly turns complex in practice. Invoices get delayed, data goes missing, and visibility between procurement and accounts payable disappears. The outcome is predictable: slower payments, more exceptions, and endless manual corrections. Procure-to-pay outsourcing can help address these challenges by streamlining processes, improving accuracy, and enhancing end-to-end visibility.

When accuracy and compliance are critical, these inefficiencies carry real cost. Late payments strain supplier relationships, fragmented systems limit visibility, and process gaps make compliance harder to sustain. Tools and minor fixes rarely solve it. The real issue lies in structure and scale.

The solution? Procure-to-pay outsourcing with a structured model that reduces errors and improves accountability. This article outlines the P2P process, key challenges, and proven practices for building an efficient, compliant outsourcing strategy—with a quick checklist to help facilitate successful P2P outsourcing strategy implementation for your org.

Key Takeaways

- Define clear, measurable goals

Before outsourcing your P2P (procure-to-pay) process, clarify what you expect — e.g., reducing invoice cycle time, improving first‐pass match rates. - Pick a partner with domain & tech expertise

The outsourcing provider needs not just process knowledge, but ERP integration capabilities, automation experience and compliance controls. - Standardise and automate workflows

Standard approval policies, vendor set-up procedures, automation of repetitive tasks (OCR, RPA) help reduce manual effort and errors. - Integration + visibility + governance matter

Integrating the P2P platform with ERP/finance systems, enforcing security/compliance controls and tracking KPIs provide real‐time visibility and stronger controls. - Supplier collaboration and cross‐functional alignment are critical

It’s not just finance & procurement alone — aligning procurement, finance, operations and using portals/self‐service for suppliers helps build trust and smoother flows.

What does procure-to-pay even mean?

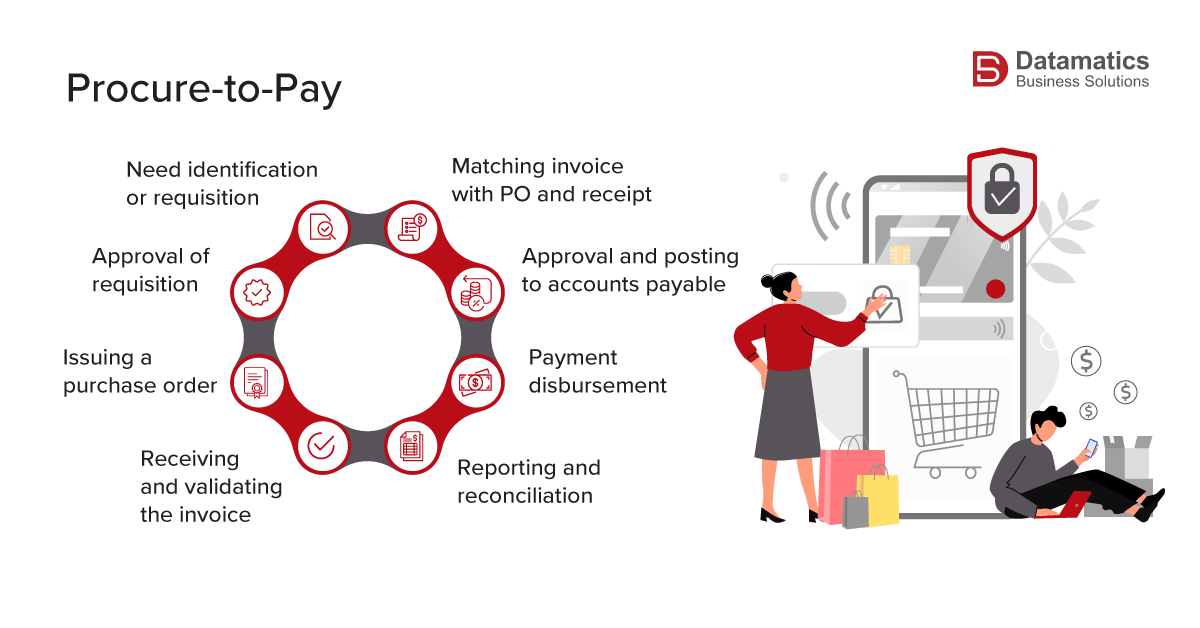

The procure-to-pay (P2P) process refers to the complete set of activities involved in purchasing goods or services and paying for them. It covers every step—from raising a purchase requisition and approving it to receiving the goods, matching invoices, and releasing payment to the vendor.

A well-structured procure-to-pay process improves transparency, strengthens internal controls, and ensures timely payments, helping finance teams maintain accurate books and strong supplier relationships.

Challenges in implementing procure-to-pay successfully

Before optimizing your procure-to-pay process, it’s important to identify the roadblocks that limit efficiency and control. Common challenges include:

- Siloed teams and unclear ownership

- Disparate systems and poor integration

- Inconsistent or duplicate vendor data

- Resistance to change and low tool adoption

- Approval delays and workflow bottlenecks

- Manual exception handling and reconciliation

- Weak compliance and security controls

- Limited visibility and lack of performance metrics

Overcoming these challenges requires more than process tweaks. It calls for specialized expertise, automation, and stronger governance across the procure to pay cycle. This is where procure-to-pay outsourcing becomes a practical and scalable solution.

How does outsourcing P2P services help address these challenges?

Outsourcing the procure-to-pay process allows organizations to transform fragmented, manual operations into an integrated and well-governed system. Instead of struggling with siloed teams, outdated tools, and compliance risks, businesses can rely on a specialized partner equipped with automation platforms, domain expertise, and scalable delivery models. This not only accelerates invoice-to-payment cycles but also strengthens financial control and visibility across every stage of the procure-to-pay cycle.

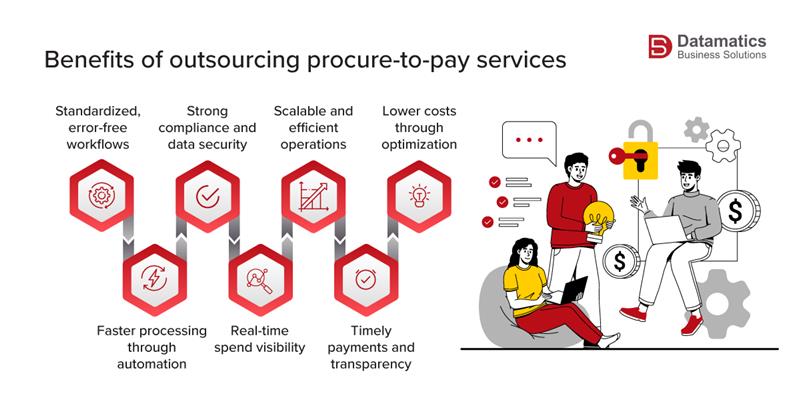

A well-structured procure-to-pay outsourcing service provides clear operational advantages:

- Standardized and streamlined workflows that eliminate redundancy and ensure consistent execution across procurement and accounts payable.

- Automation and technology integration using AI, RPA, and advanced analytics to reduce errors, speed up processing, and enable straight-through transactions.

- Enhanced compliance and control through built-in audit trails, approval hierarchies, and data security measures that safeguard against fraud and regulatory breaches.

- Real-time visibility with centralized dashboards and reporting tools that help track spend, monitor performance, and support better decision-making.

- Operational scalability and cost efficiency by reducing manual workloads, optimizing resources, and improving process turnaround times.

- Improved supplier experience driven by faster payments, structured communication, and transparency throughout the payment process.

- Reduced costs through process optimization, better resource utilization, and automation-led efficiencies that minimize overhead and rework.

As a result, adopting P2P outsourcing replaces reactive, manual efforts with a proactive, insight-driven approach that boosts accuracy, ensures compliance, and frees internal teams to focus on important tasks that matter.

You can also read: Save Hrs By Automating These 10 Finance Workflows

10 Best practices for a Procure-to-Pay Outsourcing strategy

The following are 10 critical and practical best practices to guide a successful procure-to-pay outsourcing program:

The following are 10 critical and practical best practices to guide a successful procure-to-pay outsourcing program:

1. Set clear, measurable goals

Define specific, quantifiable outcomes before outsourcing. Targets such as shorter invoice cycles or higher first-pass match rates help track progress and keep teams aligned.

2. Choose a partner with proven P2P expertise

Select a provider with strong procurement knowledge, ERP integration experience, and compliance capability. The right partner ensures seamless execution and data accuracy.

3. Standardize procurement and approval policies

Create consistent procedures for purchase approvals, vendor setup, and exceptions. Standardization reduces confusion and enforces compliance across all departments.

4. Assign clear ownership and accountability

Develop a defined RACI framework outlining who manages, approves, and escalates each task. Clear roles prevent duplication and improve decision-making speed.

5. Automate repetitive P2P workflows

Adopt RPA and OCR tools to automate invoice capture, matching, and routing. Procure to pay automation reduces audit risks, cuts manual work, and improves turnaround time, plus compliance controls.

6. Integrate systems for real-time visibility

Connect P2P platforms with ERP and finance systems to maintain a single source of truth. Integration eliminates data silos and improves reporting accuracy.

7. Enforce strong security and compliance controls

Use encryption, access controls, and audit trails to safeguard financial data. Continuous monitoring ensures process integrity and regulatory compliance.

8. Build collaborative supplier relationships

Implement self-service portals and regular performance reviews. Open communication improves payment efficiency and strengthens supplier trust.

9. Align procurement, finance, and operations

Encourage cross-functional collaboration through shared KPIs, process reviews, and training. Unified teams ensure consistency and faster adoption of new workflows.

10. Track KPIs and review performance regularly

Monitor key metrics such as cost per invoice and exception rate. Frequent reviews with your outsourcing partner help identify improvement areas and sustain efficiency.

Turn your Procure-to-pay outsourcing plan into action with this quick checklist

Use this simple, practical checklist to keep your procure-to-pay outsourcing rollout on track:

- Set clear goals and define measurable outcomes

- Get leadership approval and allocate required resources

- Shortlist and assess potential outsourcing partners

- Check system and ERP integration compatibility

- Agree on SLAs, governance structure, and data controls

- Run a short pilot to validate process and technology fit

- Record baseline metrics and monitor key process indicators

- Train internal users and vendor teams

- Adjust workflows based on pilot findings

- Roll out in phases across business units

- Review performance quarterly and make necessary updates

A straightforward checklist like this keeps the procure-to-pay process rollout focused, accountable, and results-oriented.

What’s next?

After defining a clear procure-to-pay outsourcing strategy, the next step is ensuring consistent, compliant execution. This requires a partner with process maturity, domain expertise, and the ability to integrate seamlessly into existing financial systems.

A reliable outsourcing partner helps maintain accuracy, shorten cycle times, and strengthen supplier relationships—without adding operational complexity.

How Datamatics accounting helps strengthen procure-to-pay outcomes

Datamatics BPM Accounting offers a comprehensive procure-to-pay outsourcing service suite tailored for MSMEs and mid-sized firms: vendor management, AP & invoice processing, exception handling, vendor help desk, payment reconciliation, account reconciliation, and more. AI/ML-powered tools and robust delivery centers ensure accuracy, speed, and transparency, transforming your procure-to-pay cycle into a high-efficiency engine with measurable ROI.

Ready to get started? Connect with us today to review your P2P readiness and explore a tailored transformation plan.

FAQs

1. What exactly is the “procure-to-pay” process?

The P2P process covers everything from raising a purchase request, approving it, issuing a purchase order, receiving goods/services, matching invoices and paying the vendor.

2. Why outsource the P2P process instead of keeping it fully in‐house?

Outsourcing helps address common challenges — siloed teams, disparate systems, manual exceptions, approval delays. A specialist partner brings standardised workflows, automation, scale and improved control.

3. What are some of the biggest challenges firms face with P2P?

Examples include: siloed teams & unclear ownership; disparate systems/integration gaps; inconsistent or duplicate vendor data; manual exception handling; lack of visibility & weak compliance.

4. What should you look for in a P2P outsourcing partner?

Key criteria: proven P2P domain experience, ERP/integration expertise, automation capabilities (AI/OCR/RPA), strong governance and compliance framework.

5. Which metrics or KPIs should you monitor post‐outsourcing?

Some of the metrics highlighted: invoice‐to‐payment cycle time, first‐pass match rate, cost per invoice, exception rate. Also review performance regularly with the partner.

Harsh Vardhan