Demand generation is one of the core pillars of growth for IT companies. But let’s be honest – demand generation for IT companies has changed. What used to be overly reliant on tele calling and cold emails, has now become digital inbound. And with the advent of AI, personalization is winning big.

The buyer journey has changed too. Information was scarce and sales were involved too early. But today, buyers compare vendors online. 83% of their research is already done before they come in contact with you.

They depend on research content, peer reviews, and technical insights. They rely on multi-channel discovery before they talk to you. Because of this shift, the approach to demand generation is also changing in 2026.

However, IT companies face a unique challenge. Their offerings are complex. Their sales cycles are long. Their buyers are technical and risk-aware. To scale demand generation in this space, companies need a mix of strong data, clear messaging, and a structured multi-channel plan.

In this guide, I have broken down the nitty-gritty of demand generation services for IT companies. It also includes insights on how DBSL supports IT services companies with full-funnel demand programs. Keep scrolling to learn more.

Why Demand Generation Matters for IT Companies in 2026?

The IT buying process has changed more in the last five years than in the previous decade. Buyers now explore on their own before talking to sales. A Gartner report shows that 83% of the B2B buying process happens before a buyer reaches out to a vendor. This has created new expectations.

1. Buyers want proof, not claims. They compare case studies, whitepapers, product/service details, and demos. Claims have to be substantiated with proof.

2. The IT market is crowded. There are thousands of providers offering similar services.

3. Deals take longer. Most enterprise IT services companies see sales cycles extend from 6 to 18 months. A lot of it depends on the complexity of the deal as well.

4. Multiple teams influence the purchase. IT, security, operations, finance, and leadership all weigh in.

Demand generation solves these challenges by informing, nurturing, and engaging buyers long before they speak to sales. By guiding them with the right content, you can build trust through proof. With demand generation, accelerating their journey from awareness to qualified intent becomes easier.

Key Takeaway

Demand generation sets the stage for trust, education, and early engagement before the sales cycle begins, therefore making it imperative for IT companies in 2026.

You can also read: How is AI Shaking Up Demand Generation?

What Makes Demand Generation Services for IT Different?

Most industries rely on promotional messaging. IT buyers rely on insight-driven messaging. They look for clarity, depth, and expertise. Here is what makes IT demand gen distinct:

1. Technical decision-makers need detailed content

They want real examples, not tall marketing claims. They evaluate architecture, scalability, integrations, and performance of what you have to offer. If the content doesn’t answer “will this work in my environment?”, they move on

2. Multiple buying groups must be convinced

Developers care about tools. CIOs care about risk. CFOs care about cost. Legal cares about compliance. Operations cares about implementation. Every group has different concerns, and all of them influence the final yes. So, to succeed in IT companies, you need to cater to multiple buying groups.

3. IT initiatives are risky

Adoption of AI, cloud transformation, data migration, and security enhancements are delicate initiatives with no margin for error. A single poor choice can result in security vulnerability, financial loss, or downtime. Therefore, consumers look for suppliers who exhibit confidence and dependability. It will become crucial to follow rules and regulations.

4. IT companies have to describe "how it works"

Customers are interested in the delivery schedule, procedure, and timetable. They must comprehend the process, SLAs, handoff phases, and anticipated results. Being transparent turns into a competitive advantage.

When combined, these elements produce a purchasing environment where depth is more important than ornamentation. IT executives don’t want generic advertising. They are searching for partners who can demonstrate their ability to deliver, speak their language, and comprehend their difficulties.

Demand generation for IT must therefore go beyond superficial marketing and offer material that influences choices, fosters trust, and withstands technical analysis.

Key Takeaway

The creation of IT demands must prioritize technical relevance, clarity, and trustworthiness. Brands that educate consumers, reduce choice risk, and show knowledge from the initial point of contact are rewarded by consumers.

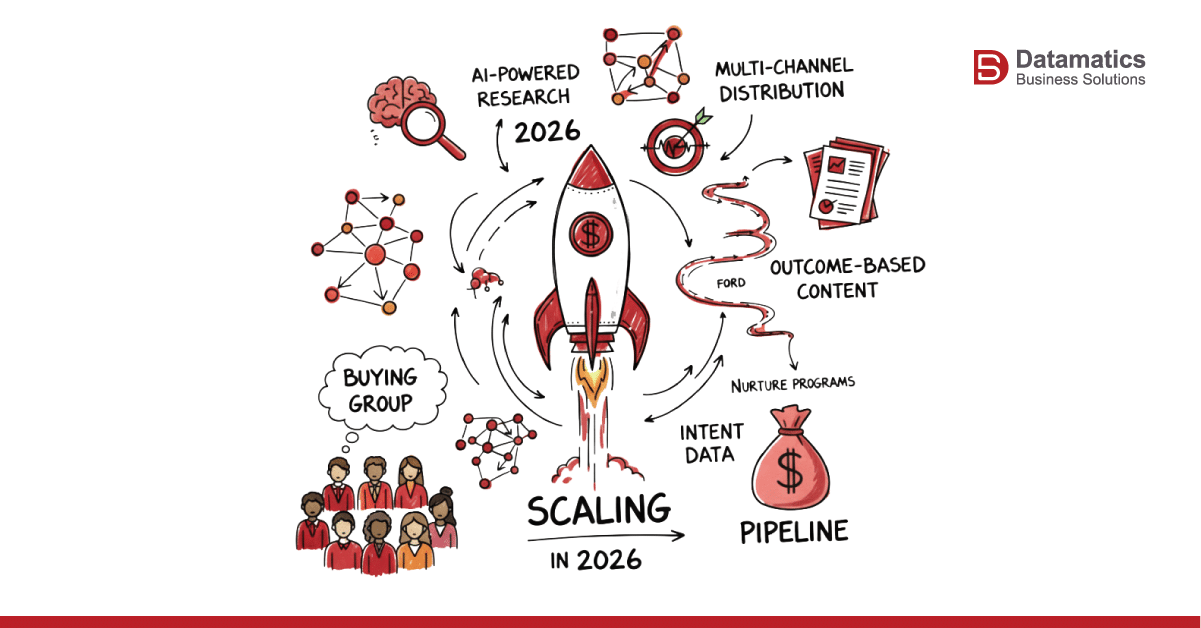

Top Trends Shaping Demand Generation Services in IT for 2026

Now that we understand how demand generation services are different for IT companies and why they absolutely need demand generation, let us look at what shifts are reshaping how IT companies attract buyers.

1. AI-Powered Research

Buyers now routinely turn to LLMs. You know the likes of ChatGPT, Gemini, Perplexity and Copilot. Why do they use? Well, in most cases, they use such tools to scope out vendors, compare features, and synthesize reviews before they even think about reaching out. A recent study shows that 94% of B2B buyers use LLMs somewhere in their evaluation process.

As buyers increasingly rely on these tools, strong organic presence with robust content, authoritative reviews, clear positioning becomes imperative for vendors to surface in these early stage searches.

Bonus Read: Top AI Tools Transforming Demand Generation

2. Shift Toward Outcome-Based Content

Today’s IT-buying stakeholders (CIOs, CFOs, operations, security leads) aren’t swayed by buzzwords. They want concrete value like lower downtime, faster deployments, better user experience, and proper adherence to compliance and policies.

This demand for results-oriented content means vendors must lead with proof. Case studies with metrics, real-world success stories, before/after benchmarks can be essential to stand out. In fact, over 90% of modern B2B buyers validate vendor claims against evidence such as peer reviews and documented outcomes.

3. Rise of Peer Review Platforms

Peer-review sites like G2, Gartner Peer Insights, TrustRadius, Capterra are now a core part of early-stage research for IT buyers. On Gartner Peer Insights alone, the platform covers 840+ technology categories and hosts over 760,000 vetted reviews across 28,600+ vendors.

Such platforms have become trusted third-party validators — buyers treat them as objective, peer-based evidence rather than marketing content.

4. Buying Groups Instead of Single Leads

Technology buys are no longer decided by a single stakeholder. According to recent industry data, more than 80% of B2B tech purchases now involve four or more stakeholders across departments — IT, security, operations, finance, sometimes even leadership and end-users.

As a result, demand generation must address different personas and their distinct concerns — cost, risk, user-friendliness, compliance — in a unified narrative

5. Focus on Full-Funnel Content

Top-of-funnel blogs and awareness posts aren’t enough anymore. Buyers expect a full spectrum of content: demos, comparison sheets, video explainers, technical guides, ROI calculators, pilot frameworks or best-practice playbooks. Studies show that 59% of decision-makers find product-sheets most helpful when evaluating shortlisted vendor solutions, and over half rely on case studies for final validation.

Modern demand generation services must therefore deliver value at every stage. Be it awareness or evaluation, each stage should offer something.

Together, these trends underscore a profound shift in how IT companies must approach demand generation. The market no longer rewards broad-brush promotion or shallow messaging. Instead, success goes to those who build trust, deliver clarity, and meet buyers where they already are. All of this while being equipped with insight, proof, and context.

The vendors that win will be those that help buyers navigate complexity confidently, giving them the evidence, guidance, and assurance, they need to make high-stakes tech decisions.

Key Takeaway

The demand-generation strategy for 2026 must support multi-role buyers, peer influence, and AI-based discovery backed by outcome-driven content, deep technical insight, and third-party credibility.

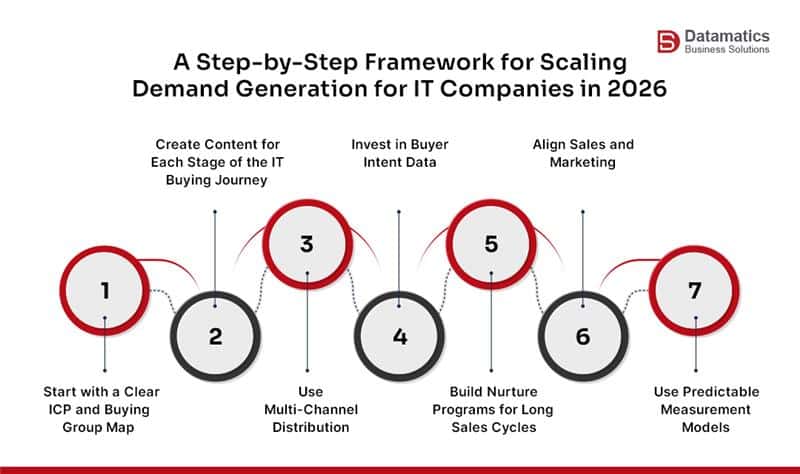

How to Build a Scalable Demand Generation Strategy for IT Services

Below is a step-by-step framework for scaling demand generation for IT companies in 2026

1. Start with a Clear ICP and Buying Group Map

Scaling demand begins with precision. A well-defined ICP is more than a description of the “type” of company you want. It is a blueprint for who is most likely to convert, expand, and stay. A strong ICP should include not just industry, but maturity, team structure, tool stack, budget realism, geographic constraints, regulatory expectations, and the operational pain points that trigger buying cycles.

Once the ICP is set, map the buying group. In IT companies, that typically includes the CIO, CTO, IT Manager, Security Lead, Operations Lead, and Finance Lead. Each of these roles has different priorities and your messaging must speak to all of them. When you understand who influences the deal and what they care about, scaling demand becomes far more predictable.

2. Create Content for Each Stage of the IT Buying Journey

IT buyers don’t skim and convert. They research deeply, validate thoroughly, and move through a structured journey:

a. Problem Awareness: They look for blogs, trend analyses, and reports that help them define what is wrong or what is changing in the market.

b. Solution Exploration: In IT companies, buyers almost always compare approaches and technologies. So, more room for explainers, comparison guides, and POVs.

c. Vendor Evaluation: Once they are aware of the problem and the solution, they dig into case studies, ROI models, pilot frameworks, and security or compliance details to see if your offering fits their environment.

d. Decision: This stage demands live demos, roadmap conversations, detailed implementation plans, and stakeholder consultations.

A Forrester study notes that 72% of buyers shortlist vendors based solely on digital content. This means if your content isn’t answering the deeper questions, you are out before the first sales call.

3. Use Multi-Channel Distribution

IT buyers don’t follow a straight path when researching. They move between LinkedIn, Google search, peer reviews, and technical communities. They gather information in pieces. That is why a strong demand strategy isn’t just about being present on many channels. It is about using each one with intention.

On LinkedIn and ABM platforms, you reach the entire buying group with personalized messages that speak to their individual challenges and priorities. In technical communities like Reddit, Stack Overflow, or GitHub, you build credibility by showing real expertise instead of pushing a pitch.

Analyst platforms such as TechTarget or Gartner help you get in front of accounts already researching your category, giving you visibility when intent is highest. And on YouTube, deeper product demos, technical walkthroughs, and “how it works” videos help technical users understand exactly what you can deliver.

When each channel reinforces a different piece of your story, buyers stay engaged no matter where they enter the journey.

4. Invest in Buyer Intent Data

Intent data has become one of the most reliable growth levers in IT demand generation. It reveals which companies are searching for what. Instead of pushing campaigns blindly, teams can focus their energy on accounts already “showing digital signals.”

According to TechTarget, intent-driven programs improve conversion rates by 2.8x. This is not because they are more aggressive, but because they are more aligned with actual buyer behavior. You engage buyers when they care, not when your calendar says so.

5. Build Nurture Programs for Long Sales Cycles

Enterprise IT buying cycles can stretch anywhere from 6 months to 18, depending on complexity. During this time, buyers seek education, reassurance, and validation. Strong nurture programs become your silent salesperson. These efforts are always present, always helpful, always moving buyers one step closer.

Effective nurture tracks go beyond simple email drips. They include retargeting campaigns, webinars, deep dives, ROI stories, mini case studies, and executive-level insights. When nurtures are done well, your brand becomes the “default option” long before the final decision meeting.

6. Align Sales and Marketing

Scaling demand is impossible when sales and marketing operate in silos. These teams must function as one continuous engine. That means working from the same CRM, agreeing on what qualifies as a sales-ready lead, reviewing accounts together, evaluating engagement signals, and sharing feedback in both directions.

HBR reports that when teams are aligned, they grow 67% faster than those that operate independently. In the IT world, where deals involve multiple stakeholders and long cycles, this alignment directly influences pipeline quality, velocity, and conversion

7. Use Predictable Measurement Models

Traditional MQL metrics no longer reflect reality in IT buying. To scale demand, teams must track deeper and more meaningful indicators such as buying-group penetration, account engagement across touchpoints, content consumption patterns, influence on pipeline, time to conversion, and deal velocity improvements.

Modern measurement frameworks help sales and marketing teams focus on what genuinely drives revenue, instead of celebrating vanity metrics. Predictability in measurement creates predictability in pipeline — and that’s the foundation of scalable demand generation.

Scaling demand generation for IT services is not about running more campaigns or increasing volume. It’s about building a system that understands buyers, supports long decision cycles, answers technical questions, and engages multiple roles simultaneously. When your messaging, content, channels, sales teams, and measurement framework all move in harmony, demand stops being reactive. It becomes something you can engineer, optimize, and expand with confidence.

Key Takeaway

Precision targeting, full-funnel content, multi-channel presence, intent-driven engagement, long-term nurturing, sales-marketing alignment, and measurement frameworks that mirror how contemporary IT buyers truly assess and select vendors are all necessary for scaling demand in 2026.

Common Mistakes IT Companies Make in Demand Generation

Not all IT demand generation programs land the way they should. These are some of the common mistakes teams run into:

a. Too much focus on lead volume

When the target is just “more leads,” teams usually end up collecting a long list of people who will never buy. Sales wastes time chasing names instead of real opportunities, morale drops, and the funnel looks busy but doesn’t move.

b. Not enough focus on buying groups

Most IT deals involve five, six, sometimes seven people. If your content and outreach speak to only one person, you are missing the others who actually shape the final decision. This slows deals down or stops them altogether.

c. Weak differentiation

If a prospect can’t quickly understand what makes you different, they won’t spend time figuring it out. In a crowded market, “sound the same” is the fastest route to being forgotten.

d. Overly technical messaging

Technical depth is important, but when everything sounds like documentation, it loses the attention of senior decision makers. CIOs, CFOs, and COOs want to know the business impact before they care about the tech behind it.

e. No nurturing

Most leads aren’t ready to talk to sales on day one. When companies ignore these early-stage prospects, they leave months of potential engagement on the table. Nurturing is what keeps the relationship warm until timing aligns.

f. No content for the comparison stage

Buyers always compares vendors. If you don’t give them the material to do it, they will look elsewhere. That usually means they end up reading the competitor’s content instead of yours.

g. Poor data hygiene

Old emails, incomplete profiles, duplicate records — all of this makes targeted outreach much harder than it needs to be. When the data is messy, even the best campaigns lose their impact.

h. Overreliance on one channel

Putting your entire demand generation strategy into a single platform is risky. Costs change, algorithms shift, and suddenly the channel you relied on stops performing. A healthy demand engine needs more than one path to reach buyers.

These issues slow growth and create noise instead of momentum. They make dashboards look busy, but they don’t build pipeline. So, when planning demand generation for 2026, ensure you avoid these pitfalls at all cost.

Key Takeaway

Most of these mistakes happen when the focus is on collecting leads quickly instead of building real, long-term demand that keeps the pipeline moving month after month.

How Datamatics Business Solutions Supports Demand Generation Services for IT Companies ?

As one of the leading demand generation companies, Datamatics Business Solutions works with IT companies to build predictable pipeline through structured demand generation programs. The DBSL approach starts with a deep understanding of your ICP, services, and target industries. The team studies buying groups, decision-makers, and the common triggers that influence IT projects. We then create a demand plan that covers all stages of the IT buying journey. This includes awareness programs, content syndication, webinar outreach, buying group targeting, and validated lead delivery. Every lead passes through a strict quality process. Fields are checked for accuracy. Business emails are validated. Duplicates are removed. This ensures clean and ready-to-engage prospects.

One of our strengths is that our services don’t limit to demand generation. We also have robust data services. We support data enrichment, cleansing, and continuous correction of your existing CRM or marketing data. This improves targeting and raises campaign success rates.

We also believe in transparent reporting. You get clear insights on account reach, lead quality, buying group engagement, and pipeline contribution. This helps both sales and marketing plan next steps.

Our demand generation support is built for mid-market and enterprise IT needs. The focus is on quality, long-term engagement, and consistent pipeline.

Want to know how we do it? Fill out the form here and our experts will get in touch with you to give you a detailed walkthrough of our intent based demand generation services.

Conclusion

Scaling demand generation in 2026 isn’t about more emails or bigger lists. It is about building a system that matches how IT buyers actually make decisions today. They are informed, skeptical, and already deep into research before sales ever gets involved. Your job is to give them clarity, proof, and technical depth, not more noise.

When you combine intent data, thoughtful nurturing, and content built for AI discovery, demand stops being reactive and starts becoming predictable. The teams that make this shift now will lead the market; long before their competitors catch up.

Frequently Asked Questions: Demand Generation Services for IT Companies

Q1. What is demand generation for IT?

It is the process of creating interest and pipeline for IT companies through content, campaigns, and targeted outreach.

Q2. Why do IT companies need demand generation?

The sales cycle is long, complex, and involves multiple decision-makers.

Q3. Which demand generation channels work best for IT companies?

Demand generation channels like LinkedIn, content syndication, webinars, Google Search, peer reviews, and email nurturing work best for IT companies.

Q4. Does demand generation help enterprise IT deals?

Yes, because it educates buyers early and supports long evaluation cycles.

Q5. How long does IT demand generation take to show results?

Early results show within 30–60 days. Full pipeline impact takes longer.

Carly Jaspan