For many organizations, especially companies growing beyond domestic boundaries, finance operations no longer end at month-end close or regional reporting. With increasing business complexity, the spotlight is on how the finance function can scale, flex, and influence with speed. GCCs were historically seen as offshore cost arbitrage or “back-office support” hubs for finance operations. But now they are undergoing a dramatic transformation, with evolving models like GCC-as-a-Service, that not only support global finance operations—but redefine them.

In the Deloitte Finance Trends 2026 survey, ‘more than half of CFOs surveyed (57%) say they are now among the top leaders influencing strategy development across the organization,’ empowering them to drive business outcomes by orchestrating collaboration and driving transformative growth. In 2026, GCCs will prove to be the ultimate global command centers, shaping markets and experiences across continents. They will be strategic engines for global finance operations, supply chain optimization, sustainability, digital experiences, talent development, and process agility.

If you’re a CFO or finance leader, it’s time to ask: How will the GCC model enhance our global finance function? And what must we do now to leverage this shift?

Key Takeaways

- The role of a Global Capability Center (GCC) is evolving from a back-office cost-centre to a strategic finance hub: by 2026, GCCs will handle not just transaction processing but full value-chain finance operations including FP&A, tax, treasury, controls and analytics.

- Technology (automation, AI/ML, cloud platforms, real-time dashboards) will be core to GCC-based finance functions, enabling a shift from “close & report” to “predict & advise”.

- Talent strategy changes: GCCs will demand new skills (analytics, digital finance, business-partnering) rather than traditional ledger roles; hybrid models (onshore strategic + offshore/nearshore delivery) will become mainstream.

- Strong governance, compliance and risk management become foundational: With global operations and multiple jurisdictions, GCCs will enable centralized controls, traceability, continuous monitoring and standardization across geographies.

- For many organisations the adoption of a model like “GCC-as-a-Service” offers a faster, outcome-driven way to launch and run a global finance centre—sharing infrastructure, governance and scaling through a partner rather than building a full captive.

Why GCCs Matter for Global Expansion in 2026

The growth of GCCs is very evident in compelling numbers. India’s flexible office market is growing at an unprecedented pace, leading the expansion across the Asia-Pacific region, as per latest reports.

According to a Cushman & Wakefield study, the country now boasts 85 million sq. ft. of flexible office space — with 35 million sq. ft. added in the past three years alone. A major driver of this boom is the wave of mid-tier global firms establishing GCCs for the first time. The trend shows no signs of slowing — GCCs are projected to lease another 50–55 million sq. ft. by FY27, as per ICRA. In the second quarter of 2025, the banking and financial services sector was the leading contributor to GCC leasing activity in India, underscoring the cost arbitrage offered by the large and diverse talent pool and policy support amid the rapid digitization of financial services.

More importantly, the role of GCCs is shifting from transactional support to value creation. A recent survey by BCG says that the most mature GCC ecosystems in the world are India, the US, and Mexico, with India offering a unique balance of scale, innovation, and efficiency.

Towards the end of 2025 alone, companies that have established GCCs in India include –

Global investment management giant Vanguard with its first GCC in Hyderabad (a city already home to more than 300 GCCs), with plans to grow to a 2500-strong team by 2029

McDonald’s has officially opened its first Global Capability Center in India to drive technology and innovation for its worldwide operations – its largest centre outside the US.

German company Deutsche Börse sets up GCC, which is expected to create about 1,000 IT jobs over the next two years.

Global hospitality major Marriott International has announced plans to establish its first offshore GCC in India to support the company’s global operations across 141 countries and territories, focusing on technology, engineering, cybersecurity, and digital solutions.

What does this mean for global finance?

For global finance operations, the growing shift towards GCCs to optimize innovation, competitive differentiation, and efficiency creates similar opportunities to transform core finance and accounting activities.

Some of the transformative changes that can be expected in global finance operations include:

- Economies of scale and global orchestration: Rather than separate finance teams in each country or region, a GCC allows central governance, uniform processes, and shared data platforms across time zones.

- Technology-enabled, data-driven finance: With automation, machine learning, and real-time dashboards embedded in GCC frameworks, finance teams can shift from “close and report” to “predict and advise.”

- Flexible talent models and cost leverage: GCCs positioned in talent-rich regions provide high-quality finance, analytics, and tax expertise at competitive cost, while allowing your leadership to focus on strategy, not operations.

- Resilience, agility, and governance: With uncertainties such as regulatory changes, tariffs, global supply chain disruptions, or remote workforce constraints, a GCC with strong governance can keep finance operations stable and responsive.

In short, by 2026, GCCs will be a lever for finance transformation, not just cost reduction.

You can also read: GCCs vs Outsourcing: The CFO’s Guide to Choosing the Right Global Delivery Model

Key Areas Where GCCs Will Redefine Finance Operations

Let’s look at five major finance-functional areas where GCCs will drive transformation:

1. Shared Services & End-to-End Finance Processes

Traditionally, GCCs handled transactional finance: accounts payable, receivables, payroll, and basic reconciliations. But by 2026, GCCs will own end-to-end finance value chains — including FP&A, tax preparation, financial controls, audit support, and treasury operations. This integrated model reduces hand-offs, lowers cycle times, and improves data fidelity.

As GCCs continue to evolve, finance teams are moving well beyond traditional transaction-based tasks to become actual value creators for their organizations. Their focus is expanding to include process optimization, cost transformation, and strategic business partnering across functions like procurement, reporting, planning, and analysis. While entry-level roles are increasingly centered on data analytics, FP&A, and compliance, mid-level professionals are now driving continuous improvement and transformation initiatives that elevate the finance function’s impact.

2. Automation, Analytics & AI at the Core

The backbone of the modern GCC is its digital engine. According to latest studies, GCCs that embed AI and analytics move from cost centers to value-creation hubs at a much faster pace than those that lack in adoption.

In finance operations, enterprise value is accelerated by:

- Smart reconciliations and continuous close workflows

- Predictive cash flow and liquidity forecasting

- Automated compliance monitoring and internal controls

- Real-time KPI dashboards for CFOs and business units

By 2026, GCCs will be where global financial technology is developed and managed. They become not just delivery centers but innovation-led finance hubs.

3. Talent Strategy & Finance Capability

A GCC in 2026 isn’t just about headcount; it’s about capability. Finance leaders will look for talent skilled in analytics, machine learning, process redesign, business partnering, and digital tools. A report by ACCA noted that GCCs are creating roles far beyond transaction processing—roles that contribute to planning, analysis, and transformation.

Delhi-NCR, India, hosts around 100,000 employees in financial services GCCs, roughly about 18% of the country’s total GCC headcount. A point to note is that many patents related to financial risk modelling and analytics filed are from this region, underscoring the increasingly key role the GCCs play in driving innovation and differentiation.

Key implications for your finance organization:

- Shift from traditional ledger roles to finance business partnering roles within the GCC.

- Establish training and continuous learning programs for analytics, AI interpretation, and digital finance.

- Design hybrid delivery models: onshore strategic leadership, offshore (or nearshore) delivery, and analytics.

In India, Mumbai is home to several GCCs specializing in banking, risk, ESG, and innovation. Some of the earliest and most notable GCCs include JPMorgan Chase, Morgan Stanley, Citi, and BNP Paribas.

Datamatics Business Solutions, headquartered in Mumbai, with a 50+ year legacy in business process excellence, combines deep Finance & Accounting outsourcing expertise with automation, analytics, and AI-driven innovation. Our GCC-as-a-Service model enables clients to design, build, and operate agile, compliant, and future-ready global centers — without the complexity of traditional setups — helping them tap into our established, compliant ecosystem of people, processes, and physical infrastructure.

4. Global Compliance & Risk Governance

With global operations comes global compliance risk: multiple jurisdictions, transfer pricing, tax reporting, and ESG disclosures. GCCs provide a unified platform for governance, standardisation, and audit readiness.

For finance operations, this means:

- Unified global controls and policies implemented from the GCC hub.

- Continuous monitoring and analytics for regulatory risk, financial crime, and tax exposure.

- Shared data platforms ensure traceability and audit trails.

5. Agility, Resilience, and Leadership of the Future

In volatile times—think geopolitics, tariffs, supply chain disruptions, shifts in talent availability—CFOs need agility and resilience built into global finance operations. GCCs give you that by providing:

- Flexibility in talent sourcing across regions and time zones

- Centralised data, decentralised execution—allowing rapid pivoting

- Innovation labs within GCCs that explore new tools, business models, and structures

- Strong strategic alignment with headquarters while delivering global operations

By 2026, leading GCCs will operate with near-real-time insights, decentralised execution nodes, and global orchestration—all functioning as the enterprise’s global finance nerve centre.

What is the Best Global Delivery Model?

If you’re a CFO or finance leader, you should follow a robust roadmap to align your global finance operations with the GCC’s evolution. From deciding on the GCC delivery model onwards, you need to be clear on your strategic goals and priorities.

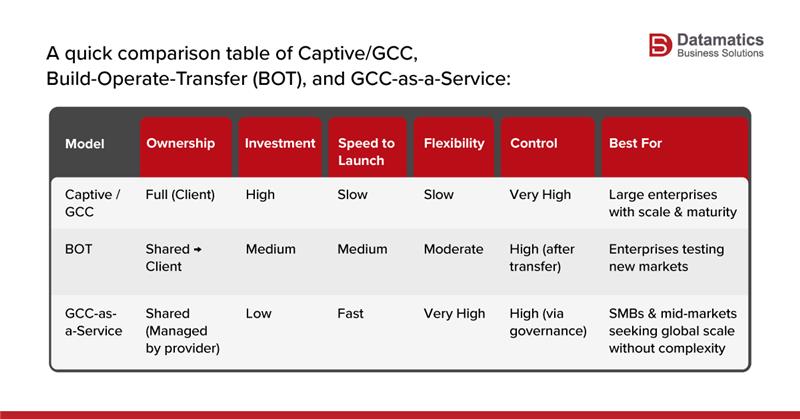

Below is a distinction that will help C-suite and enterprise leaders evaluate the major global delivery models — Captive/GCC, Build-Operate-Transfer (BOT), and GCC-as-a-Service — in terms of structure, ownership, flexibility, and strategic impact.

Among the models, the GCC-as-a-Service model is an evolution of traditional captives and BOT setups. It is modular and outcome-driven, offering the best of all options. When you team up with us through GCC-as-a-Service, we design, build, and run the global center on your behalf with shared governance and transparent SLAs. This ensures flexibility and performance, whether or not there are transfer obligations.

What Success Looks Like in 2026 and Beyond

By 2026, the finance function will not be only delivering numbers or managing data. They will be using predictive analytics to forecast future liquidity stress, executing closes in drastically reduced timelines, automating global entity reconciliations and transfer pricing controls, and driving decision-making, to name a few.

Talent and technology will enhance the function’s value and the CFO’s ability to steer the organization towards sustainable growth and technological resilience.

The Risks and How to Mitigate Them

Even as GCCs promise transformation, they come with risks. Finance leaders must manage:

- Centralisation of control might compromise agility. Business leaders will have to ensure that collaboration and partnerships are nurtured and sustained.

- Technology lag—delays in data integration or automation may impede innovation and value creation.

- Continued talent development—a talent development plan aligned with broader organizational goals, industry best practices, and regional needs — is essential for GCC success (which is actually people success).

- Governance blind spots—global compliance risk amplified if controls are weak.

- Change fatigue—moving to a hub model requires people, process, and technological change management; manage with care.

Mitigation strategies: phased rollout, strong governance, comprehensive training, and hybrid delivery models that balance centralisation with regional responsiveness.

Conclusion

The modern GCC is no longer just a back-office cost centre — in 2026, it becomes the engine room of global finance operations. For CFOs and financial leaders, this means seizing an opportunity to redesign how finance works: from transaction processing to strategic decision-making, from manual reconciliation to predictive analytics, from regional silos to global orchestration. If you’re planning a global finance operations transformation, the time is now. Start aligning your delivery model to the GCC paradigm, invest in digital finance capabilities, hire the right talent, build governance frameworks, and let your finance hub become a catalyst for business growth—not just cost efficiency.

By 2026, firms with effective GCCs will not only deliver faster, cheaper operations—they’ll also provide smarter, more agile finance that powers global competitiveness.

FAQs

1. What is a GCC-as-a-Service model?

A GCC-as-a-Service model allows a company to partner with a provider who designs, builds and operates the global capability centre on behalf of the company (shared governance, managed delivery), enabling faster setup, lower investment and high flexibility.

2. Which finance processes will GCCs handle by 2026?

By 2026, GCCs are expected to handle end-to-end finance operations: transactional (AP, AR, payroll) and higher value functions such as FP&A, treasury, tax, audit support, analytics and real‐time decision support

3. What are the key criteria when selecting a finance-GCC provider?

Important criteria: strong compliance frameworks (e.g., GDPR/SOC/ISO), robust technology stack (automation/AI/cloud), scalability/flexibility to handle growth, and talent capability in analytics and business partnering.

4. What are the risks of transitioning to a GCC model and how can they be mitigated?

Risks include: over-centralisation reducing agility; technology integration delays; talent gaps; weak governance. Mitigation involves phased rollout, hybrid delivery models, strong governance from day one, continuous training and change-management.

5. When is the right time for an organisation to adopt a GCC or GCC-as-a-Service for finance operations?

Typically when: internal finance teams are overloaded with routine transactions, you see growth in complexity/multi-jurisdictions, you want to shift internal teams toward advisory roles, you need

Raajiv Sachdeva