Demand generation has become one of the biggest levers for modern B2B growth, especially as buying cycles stretch and competition increases. In one recent pipeline study, 81% of B2B marketers said acquiring new qualified leads is either “mission-critical” or an “urgent priority,” yet more than half admitted they rarely hit their lead-gen goals.

This gap between what is expected and what actually happens is exactly why so many mid-market and enterprise companies are turning to demand-generation partners. They need predictable revenue, not sporadic spikes.

But choosing a demand generation services partner is tricky because the market is flooded with agencies that all sound similar on the surface. Some talk about “demand gen” when they are simply selling cold email blasts or generic PPC campaigns.

True demand generation is very different. It builds awareness, shapes buyer understanding, and creates interest long before a prospect ever fills out a form. In fact, studies show that today’s B2B buyer is already 60–70% through their decision-making process before engaging a vendor. This means if your brand isn’t visible early, you won’t even make the shortlist.

The right demand generation services partner shouldn’t feel like a vendor at all. They should feel like an extension of your growth team. Someone who understands your audience, strengthens your brand narrative, and brings in the right accounts at the right stage.

For mid-market and enterprise companies where deal cycles are long and buying committees are complex, this kind of partnership is what fuels steady, scalable pipeline.

So, how do you find the right demand generation company?

This guide breaks down the selection process. It shows what to look for, what questions to ask, and what signals to avoid. It also covers the role of data, channels, and metrics that matter.

What Are B2B Demand Generation Services?

B2B demand generation services are designed to help mid-market companies and enterprises get in front of the right buyers, spark genuine interest, and steadily grow their pipeline.

Instead of focusing on one-off lead grabs, these services support the entire buyer journey. So, from the moment someone becomes aware of your brand to the point where they show real purchase intent, everything gets included in demand gen services.

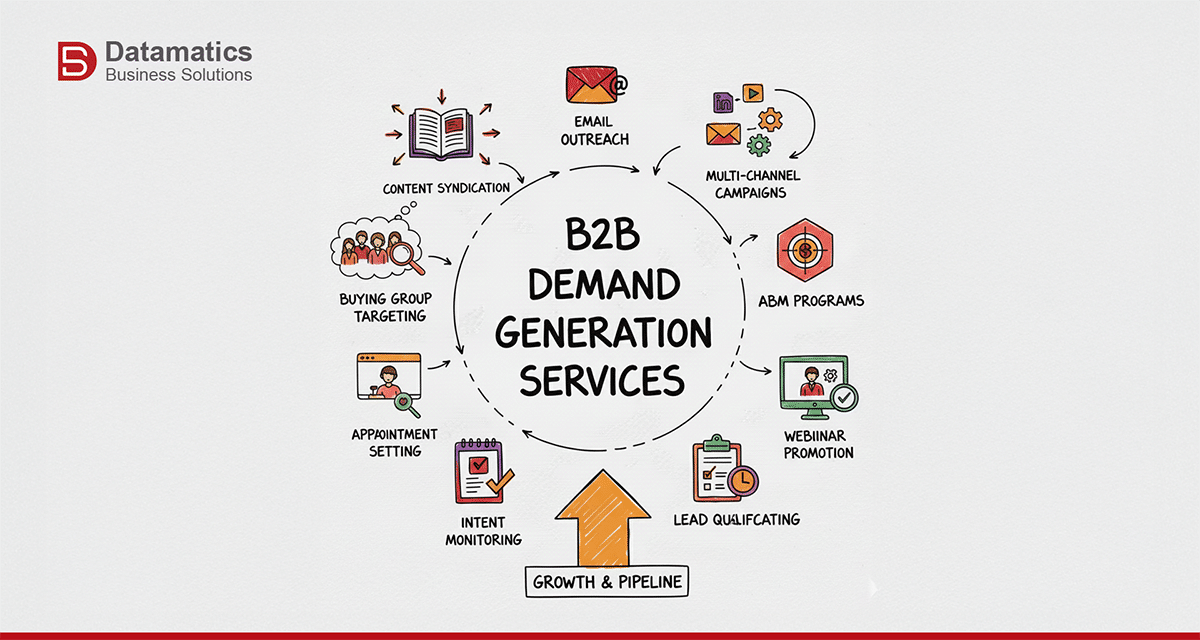

A strong demand gen partner usually brings a mix of programs together, such as content syndication to expand reach, targeted email outreach, multi-channel campaigns, and buying-group level targeting for complex deals. They may also run ABM programs, promote webinars, monitor intent signals, qualify leads, set appointments for sales, and clean or enrich your data so your targeting stays sharp.

The common thread across all these services is alignment. The aim is to ensure that you are speaking to the right accounts, in the right channels, at the right stage of their decision-making process.

Mid-market and enterprise buyers rarely move in a straight line, which is why demand generation has evolved into a blend of content, insights, outreach, and intelligent follow-up. Not just a numbers game.

Key Takeaway

Demand generation services help companies reach the right buyers at the right time across multiple channels.

Common Types of B2B Demand Generation Services

Mid-market and enterprise companies use different demand generation services. Their goals, budget and even the complexity of the buyers can determine the kind of services they need.

Most demand generation services providers offer a mix of different programs. Mid-market and enterprise companies use a combination of these programs that ultimately help them drive awareness, increase engagement, and build a strong pipeline.

1. Content Syndication Services

Content syndication is the process of republishing your existing content on third-party websites to increase their reach. Such services help you get your whitepapers, guides, blogs, and reports in front of verified buyers. These buyers are usually are already interested in the product/service you have to offer. Instead of hoping people find your content on their own, it is pushed directly to the right roles.

This is one of the fastest ways to expand top-of-funnel reach and capture interest from people who may not yet know your brand.

2. ABM Campaigns

Account-Based Marketing (ABM) campaigns focus on a smaller list of high-value companies and engage them across channels like LinkedIn, email, targeted ads, and content offers.

The goal is simple – warm up your dream accounts and increase your chances of getting into their buying cycle early. ABM works especially well for companies with long sales cycles or complex products. Therefore, perfectly suited for mid-market and enterprise companies.

3. Buying Group Targeting

Most big B2B deals need buy-in from multiple people, not just a lone decision-maker. Buying group targeting makes sure you are engaging the entire committee. This could include everyone from end users to influencers, budget owners to executives.

This approach raises your chances of staying relevant even if someone changes roles, leaves the company, or stalls the process internally.

4. Intent-Based Outreach

Intent data tools track when companies are researching topics related to your product. This includes everything like who are reading articles, comparing vendors, or who are searching for solutions.

Demand generation services partners use those signals to reach out at the right moment, when interest is already heating up. This often leads to stronger engagement and shorter sales cycles because you’re talking to buyers who are already active.

5. Lead Qualification and Nurturing

Not every lead is ready for sales right away. This service keeps prospects engaged through emails, phone calls, and multi-touch outreach until they show clear buying intent.

It filters out junk, identifies real opportunities, and prevents good leads from going cold due to lack of follow-up. It also saves your sales team a ton of time.

6. Appointment Setting

Appointment-setting teams take qualified leads and convert them into booked meetings for your sales reps. They confirm interest, check fit, verify details, and only schedule conversations that are actually worthwhile.

This is especially helpful for companies that struggle with SDR bandwidth or follow-up consistency.

7. Webinar Demand Programs

Webinars work well when you need education-led engagement, but getting the right people to register is the real challenge. Webinar demand programs handle promotion, registration, follow-up, and attendee qualification.

Instead of collecting random sign-ups, you get warm leads who attended, engaged, asked questions, or downloaded materials afterward.

Together, these services give mid-market and enterprise companies a structured way to reach the right buyers and stay present throughout the full decision-making journey. With the right mix, you don’t just generate leads—you build steady, predictable pipeline growth.

Key Takeaway

The Intent-Based Demand Generation Acceleration Curve recognizes that buyers move in waves of intent and urgency, not straight lines. By aligning activities with these shifts, businesses can stop guessing, engage the right accounts at the right time, and turn complexity into predictable growth.

Recommended Reading: How does Demand Generation Work?

Why Mid-Market and Enterprise Companies Need Demand Generation Support?

Larger companies deal with a very different reality compared to smaller teams. Their deals are bigger, the stakes are higher, and nothing moves fast. There are more people involved, more approvals, and more pressure to show exactly where revenue is coming from.

On top of that, they depend heavily on clean data, reliable attribution, and a steady stream of qualified accounts to keep long sales cycles moving.

This is where demand generation services make a real difference. They plug into the gaps most enterprise teams simply don’t have time or bandwidth to handle.

1. Complex Buying Groups

Gartner notes that the average B2B deal now involves 6 to 10 decision-makers, and in reality, many enterprise teams see even more. It is not enough to reach just one person. You need to influence IT, finance, procurement, end users, and the executive sponsor—often all at once.

Demand generation services partners help map these buying groups, tailor messaging for each role, and make sure every key stakeholder sees your brand more than once.

2. Longer Sales Cycles

Enterprise deals often take 6–12 months. Sometimes longer for regulated industries like BFSI or healthcare. During that stretch, prospects don’t magically stay warm on their own. They drift. They forget. Internal priorities shift.

A good demand gen services partner keeps your brand in front of them with steady touchpoints. They keep pushing content, webinars, nurture emails, retargeting, and timely follow-ups tied to intent signals. That consistency is what keeps deals alive.

3. Multi-channel Consistency

Most mid-market and enterprise teams want to be everywhere. Email, LinkedIn, paid ads, content syndication, events, webinars, you name it. They want to be seen! But running all these channels in sync is a full-time job.

Teams often end up with channel silos. Ads say one thing, emails say another, and sales often is out doing something totally different. A demand generation services partner brings everything under one roof so every channel supports the same message and pushes buyers in the same direction.

4. Stronger Pipeline Requirements

HubSpot reports that 61% of B2B companies struggle to maintain a steady pipeline, and this problem only grows as deal values increase. Bigger deals require more top-of-funnel volume, more nurturing, and more precise targeting.

Demand gen partners help fill that gap by identifying the right accounts, engaging them early, and passing leads that actually turn into opportunities. They do not just increase inbox clutter.

Mid-market and enterprise companies can’t afford gaps in targeting, engagement, or data accuracy, especially when deals take months and involve entire buying committees.

The right demand generation partner fills these gaps, keeps momentum going, and helps revenue teams stay in front of the accounts that matter.

Key Takeaway

Mid-market and enterprise companies need structured demand support because their buyers are complex and the sales cycle is long.

How to Choose the Right Demand Generation Services Partner?

Demand generation is important. But you know choosing the right demand generation services, that is the part most companies struggle with. A good partner can transform your pipeline. A poor fit can burn budget fast.

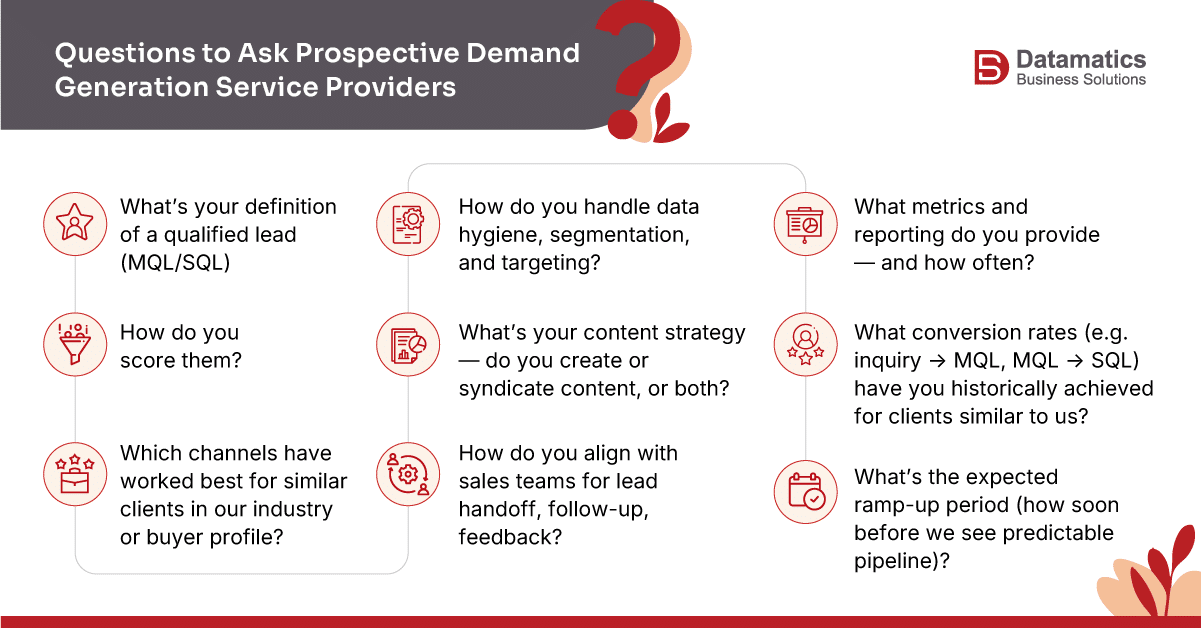

So, when you evaluate a demand-generation vendor, you really need to be rigorous. Below are key areas to dig into and why each matters.

1. Check Their Data Quality Standards

Data is the backbone of every demand generation program. So do not shy away from asking your vendor the hard questions. You know the ones like where they source their data, how often it is refreshed, whether they verify contact details, whether they support buying-group data (not just single contacts), and whether they offer ongoing cleansing/enrichment.

Now why you should care about this? Because B2B data decays fast. Various industry studies show decay rates between 22.5% and as much as 70% per year, depending on turnover, industry and how old the data is.

What this means for mid-market and enterprise companies? Well, if you buy or build a list today, a big slice of it might be useless by next quarter. Without clean, updated data, your emails bounce, your campaigns underperform, and you waste time chasing dead leads.

So the vendor you chose should provide quality B2B data.

2. Confirm the Demand Generation Service Provider's Targeting Capabilities

Data is the backbone of every demand generation program. So do not shy away from asking your vendor the hard questions. You know the ones like where they source their data, how often it is refreshed, whether they verify contact details, whether they support buying-group data (not just single contacts), and whether they offer ongoing cleansing/enrichment.

Now why you should care about this? Because B2B data decays fast. Various industry studies show decay rates between 22.5% and as much as 70% per year, depending on turnover, industry and how old the data is.

What this means for mid-market and enterprise companies? Well, if you buy or build a list today, a big slice of it might be useless by next quarter. Without clean, updated data, your emails bounce, your campaigns underperform, and you waste time chasing dead leads.

So the vendor you chose should provide quality B2B data.

3. Understand Your Demand Gen Partners Lead Validation Process

Data is the backbone of every demand generation program. So do not shy away from asking your vendor the hard questions. You know the ones like where they source their data, how often it is refreshed, whether they verify contact details, whether they support buying-group data (not just single contacts), and whether they offer ongoing cleansing/enrichment.

Now why you should care about this? Because B2B data decays fast. Various industry studies show decay rates between 22.5% and as much as 70% per year, depending on turnover, industry and how old the data is.

What this means for mid-market and enterprise companies? Well, if you buy or build a list today, a big slice of it might be useless by next quarter. Without clean, updated data, your emails bounce, your campaigns underperform, and you waste time chasing dead leads.

So the vendor you chose should provide quality B2B data.

4. Review Their Multi-Channel Strength

Enterprise and mid-market buyers rarely respond to a single outreach channel. They engage across different channels. This includes everything from emails, social platforms like LinkedIn, programmatic ads, content syndication, webinars, and nurture sequences.

A good demand generation services partner should be able to run and coordinate a multi-touch, multi-channel program. And they should be able to this while ensuring the messaging is consistent, timing makes sense, and follow-up is real.

Multi-channel demand generation isn’t just hype. Campaigns across multiple channels provide more data points, better attribution, and improved pipeline visibility.

5. Check Transparency and Reporting

While you should give your demand gen partners enough space to carry out their plans, you don’t want a black box. Your partner should be willing to share source-level reporting, channel performance, account-level engagement, buying-group visibility, touchpoint breakdowns, lead status, and regular dashboards.

Without transparency, neither you nor your demand generation company will be able to achieve the true potential. Transparency helps you track real ROI. Only when you understand where drop-offs happen, can you make informed decisions about scaling or adjusting strategy. Without it, you are flying blind. If you don’t know which channels actually drive pipeline or which parts of your demand program are wasting money, your efforts are just wasted.

6. Ask About Compliance and Security

For mid-market or enterprise buyers, especially in regulated industries, compliance matters. It is not a good-to-have. It is a must. You should ask if your vendor follows key regulations and standards. These can include data privacy laws, spam regulations, data residency where relevant. You should enquire if they have safeguards to prevent spam traps or protect brand reputation.

Clean outreach is not limited to effectiveness. It is also about being responsible and protecting your brand’s reputation.

Choosing a demand generation services partner without vetting these aspects is a gamble. With poor data, weak targeting, shallow validation, or opaque reporting, you risk wasting budget, frustrating sales teams, and damaging your brand.

Key Takeaway

Demand generation at the mid-market or enterprise level only works when it is treated as a strategic investment. A really good partner isn’t just a vendor. They are a growth engine.

How to Choose the Right Demand Generation Services Partner?

Different demand generation service providers use different pricing models. By understanding how these models work, you can avoid surprises and pick the one that matches your goals, budget, and sales bandwidth.

1. Cost per Lead (CPL)

In this model, you pay for every lead delivered. This is usually tied to basic filters like industry, geography, or job role. This model works well for top-of-funnel programs where your goal is reach and volume. It is usually the most predictable option if you need to scale awareness fast.

2. Cost per MQL or SQL

Here, you only pay after the partner validates the lead. That means your demand gen partner will check intent, verify contact details, and meet your qualification rules for every lead provided. This works best for mid-market companies or teams that want fewer but higher quality leads.

3. Cost per Appointment

You are charged only when a sales-ready meeting is booked with a qualified prospect. Often referred to as appointment setting, this model makes sense for companies with limited SDR bandwidth or teams that need guaranteed conversations instead of large lists of leads.

4. Program-based Pricing

In this model, you pay a fixed monthly fee to the demand generation services provider. It usually covers multi-channel programs like emails, LinkedIn, ads, content syndication, and nurture. This model is great for companies that want steady pipeline building rather than one-off campaigns.

5. Hybrid Models

A mix of fixed and variable pricing is what this model includes. For example, a base retainer and performance fees are levied. This gives you predictability while still rewarding the partner for hitting results.

Key Takeaway

Pick a pricing model that fits your pipeline stage, your internal sales capacity, and how much validation you expect before a lead reaches your team.

Red Flags to Watch Out for When Choosing a Partner

There are a few early warning signs that a demand generation services partner may not be the right fit for your company. These red flags usually show up before the contract is even signed. If you actually pay attention, you will be able to recognize them from a mile away. These red flags are almost always a preview of bigger problems down the line.

So, what is it that you should steer clear off? These can be compiled as follows:

a. They cannot clearly explain where their data comes from. If they dodge the question or give vague answers, it usually means the data isn’t clean, isn’t verified, or isn’t sourced responsibly.

b. They refuse to share their lead validation steps. A good partner will tell you exactly how they check emails, filter junk, and confirm intent of the ICPs. If they won’t, that is a problem.

c. They promise unrealistically fast or large results. No serious B2B provider guarantees “X leads in X days” without context. Big promises often hide weak processes.

d. They don’t support buying groups. If they only target single contacts instead of full committees, your chances of influencing a real deal drop sharply.

e. They lack basic compliance or security documentation. For enterprise deals, this isn’t optional. Missing documents usually mean risk for you and your brand.

f. They don’t share source-level reporting. If you can’t see where leads came from or how they engaged, you won’t be able to measure ROI.

g. They push for volume instead of quality. High lead volume looks good on a report but creates a nightmare for sales and drags conversion rates down.

All of these issues eventually lead to weak pipeline, frustrated sales teams, and wasted budget. Ask the right questions before finalizing your demand generation services partner.

How Datamatics Business Solutions Supports Mid-Market and Enterprise Demand Generation ?

DBSL works closely with mid-market and enterprise companies to build predictable pipeline and reach real decision-makers. The focus is on data quality, precise targeting, and multi-channel engagement.

Our demand generation strategy begins with a detailed discovery step. Our team studies your ICP, buying group roles, and revenue goals. This helps design a demand generation strategy tailored to your exact needs.

We then map the full buying journey, from awareness to interest to qualified demand. This approach makes sure every part of the funnel is covered.

Our strength lies in high-quality data. We have access to 230M+ verified data across 40+ industries. Our teams use a mix of verified data sources, enrichment, and cleansing workflows to identify the issues early on. This reduces bounce rates and improves engagement. We also monitor intent signals of the buyers. This helps you reach accounts that are already researching your category.

We run multi-channel demand programs. These include content syndication, email outreach, webinar promotions, buying group targeting, and lead qualification. Every lead goes through a strict validation process. This includes business email checks, form field verification, and manual oversight when needed.

Be it a mid-market company or an enterprise, we support long-term demand programs. This includes retargeting, nurture plans, and multi-step workflows. Want to know more about the demand generation services? Fill up the form to know more.

Conclusion

Your pipeline has huge potential when you have the right partner by your side. With the right partner combined with right approach, you can truly understand your buyers. This makes growth a lot less complicated.

Subscribe to our newsletters and stay on top of the demand generation trends.

Frequently Asked Questions: Demand Generation Services for IT Companies

Q1. What are demand generation services?

Q2. How do I choose a demand generation partner?

Q3. What is the difference between lead generation and demand generation?

Q4. Are demand generation services suitable for enterprise buyers?

Q5. How long does it take to see results?

Paul van de Kamp