For CFOs in small, mid-market, or even rapidly growing companies, global delivery models are no longer “nice to have” — they’re increasingly essential. Whether the goal is cost efficiency, better access to specialized talent, or scaling finance & accounting for innovation, choosing the right model can make a big difference. Two of the most talked-about options are Global Capability Centers (GCCs) and traditional outsourcing. Each has its strengths—and risks.

This guide will help you understand what GCCs really are, how they differ from outsourcing, and how to decide which model aligns best with your company’s strategy. With this guide, we have made it easy for MNCs and growing companies evaluating GCCs vs outsourcing to get to the right answer.

What Is a Global Capability Center (GCC)?

A Global Capability Center (sometimes known as a Global In-House Center or GIC) is a wholly owned entity of a company, often located in an offshore or nearshore location, that handles specific business functions (like finance, analytics, R&D, compliance) under the parent company’s full control. It is not merely a third-party vendor; it’s an extension of the company.

Key features include:

- Full ownership and control over people, processes, IP, and infrastructure.

- Long-term strategic alignment with corporate goals, rather than just transactional execution. GCCs increasingly handle strategic and complex functions, such as AI, analytics, and advanced finance.

- Strong governance frameworks, tighter compliance, and deeper cultural alignment with the parent organization. Because the center is part of the same company, policies, quality control, and oversight are more integrated.

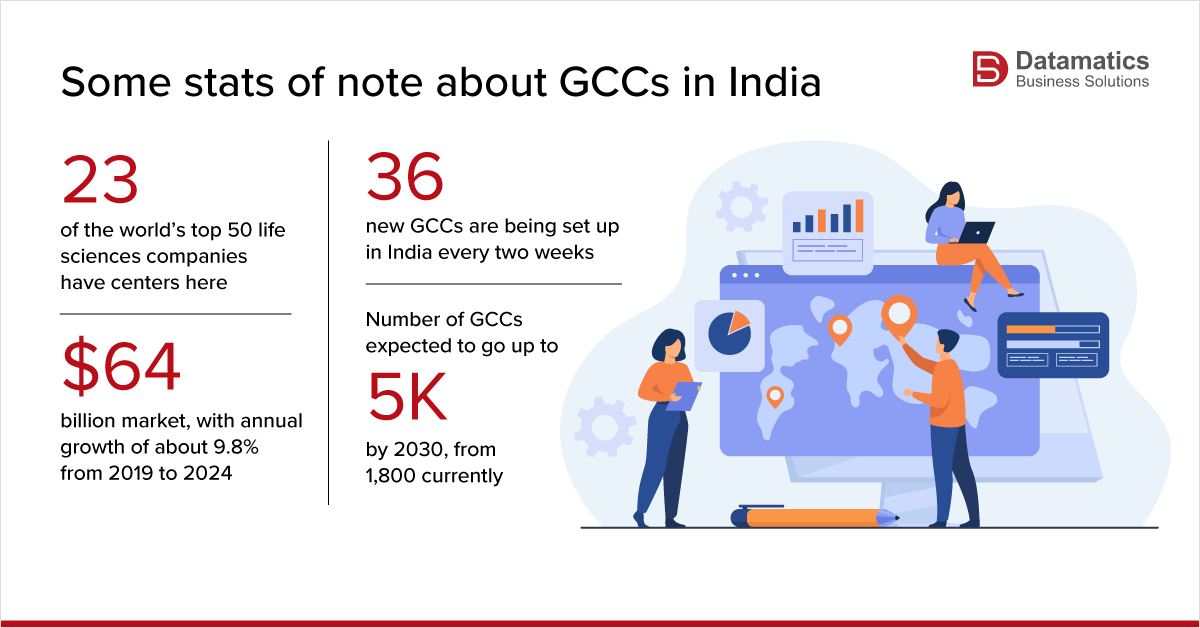

India in the Spotlight

GCCs are increasingly favouring India as a preferred location due to several crucial factors, including highly qualified and employable talent, evident cost arbitrage, a robust digital economy, and a relatively stable political environment.

Backing these strong credentials is the fact that India has been an outsourcing hub for decades, fostering cross-cultural collaboration, building institutional knowledge in several industries, including BFSI, healthcare, automotive, and telecom, and laying the groundwork for taking on more than support roles and moving into enterprise-critical mandates. These GCCs, primarily located in Mumbai, Hyderabad, and Bengaluru, represent hundreds of millions of dollars in strategic investment and thousands of jobs across the country.

As global enterprises — including mid-sized multinationals in the $5B–$15B range — expand into talent-rich hubs like India, the U.S., Mexico, China, and Poland to establish GCCs, it’s clear the model is gaining momentum.

However, that alone is not a reason enough to write off outsourcing. The global delivery landscape is far more nuanced, with many moving parts shaping what works best for each organization.

Who is Setting up GCCs in India?

A lot of global companies have established GCCs in India, especially multinational giants like Citigroup, Barclays, Unilever, Shell, and Tesco. Several MNCs, such as ArecelorMittal, Heineken, IBM, and SAP, are relocating their global capability centres, in part or in full, from Eastern Europe to India, due to increasing operational costs and talent saturation in countries like Hungary, the Czech Republic, and Romania.

Companies from Europe, particularly those from the UK and Germany, are also doubling down on their investments in India’s GCC ecosystem. Over 130 UK-headquartered companies now run Global Capability Centres (GCCs) in India, generating a staggering $6.5 billion in value in FY2024, powered by 200,000 skilled professionals.

According to NASSCOM, more than 45% of new GCCs to be established in India in 2024 have come from Europe, with Germany’s share at about 28%. India, with its vast digital economy, large talent pool, low operating costs, and mature GCC ecosystem, is proving to be an ideal partner for German firms, especially Mittelstand companies. The specialized GCC clusters in India for the automotive, engineering, and manufacturing sectors, coupled with IP protection frameworks aligned with EU norms, have driven significant growth in engineering, cloud computing, AI, and analytics.

Ready to transform your Global Capability Center into a true innovation engine?: Explore Our GCC-as-a-Service Solutions

What Is Outsourcing, and How Does It Differ?

Traditional outsourcing involves contracting a third-party vendor to perform certain functions—often finance/accounting or other operational/support tasks. Key points for CFOs:

- Outsourced vendors are external, so governance, control, culture, and IP ownership tend to be more bound by contracts and SLAs.

- Outsourcing is faster to set up, offers flexible scaling, and has lower upfront investment. It’s usually more cost-efficient in the short run for transaction-driven, well-defined tasks.

- Outsourcing may have less strategic integration. Innovating with vendor teams can be slower, and there is typically less control over knowledge retention and internalization of processes.

Key Differences: GCCs vs Outsourcing

Here are several dimensions that help distinguish GCCs vs. Outsourcing. As a CFO, these are essential criteria when evaluating:

Dimension | GCC | Outsourcing |

|---|---|---|

Control & Ownership | Full control, owns IP, infrastructure, and aligns deeply with the parent’s culture and strategy. | Contractual control via SLAs; vendor owns operations in many respects. Less direct visibility into internal process alignment. |

Strategic Role | Handles not just transactions but strategic functions: analytics, compliance, innovation, and digital transformation. | Focused more on efficiency, cost-cutting, and transactional or routine work. Innovation is less common unless specifically contracted. |

Talent & Cultural Alignment | Deeply embedded learning, development, retention; cultural alignment with parent company. Better internal career paths. | Talent management depends on the vendor; turnover, alignment, IP overlap, and domain knowledge may vary. |

Cost & Investment Profile | High initial investment (CapEx / infrastructure / management overhead), higher fixed cost but potential long-term ROI through optimization. | Lower upfront cost, variable/operational expenses, quicker ROI for tactical or immediate needs. |

Speed & Agility | Slower to set up; more planning, legal, infrastructure, hiring required; changes or scaling may take time. | More agility; you can spin up vendor teams more quickly—flexibility to scale up or down. |

Risk & Compliance | Higher control over security, data protection, governance, and IP. Better suited for sensitive industries (finance, healthcare, tech with IP). | Risks depend on the vendor: security, compliance, and data protection can be weaker unless the vendor is well-qualified and well-governed. |

When Each Model Makes Sense

Knowing the differences is one thing. But when it comes to picking one in the GCCs vs Outsourcing debate, it depends on your firm’s specific needs, stage, and priorities. Here are scenarios when each model shines:

When GCCs Make Sense

- You have long-term strategic goals involving innovation, analytics, technology, or IP-sensitive work.

- You need tight control over data, compliance, or IP and want governance, cultural alignment, and oversight more deeply embedded.

- You anticipate high growth, scaling in volume or complexity that makes vendor costs, turnover, or quality issues increasingly painful.

- You have capital or are prepared for fixed commitments (such as infrastructure, leadership, and training), and the patience for ROI over 2-5 years.

- Your firm operates in regulated sectors or handles sensitive financial, tax, audit, or trade data, where risk matters significantly.

When Outsourcing Is a Better Fit

- Your needs are more transactional, well-defined, and non-strategic: AP, AR, payroll, basic reconciliations, and bookkeeping.

- Speed and agility are priorities: you need capacity quickly without investing in infrastructure.

- You want flexibility in scaling up/down or managing costs in the short term.

- Your internal finance team is lean and needs help without making a strategic long-term investment.

- You are at an early stage (startup / SMB) and want to keep fixed costs lower while assessing what functions you’ll scale.

Hybrid & Transitional Models

It’s rarely an all-or-nothing decision in a GCCs vs outsourcing discussion. Many companies find a hybrid model works best — combining GCCs for core capabilities and strategic innovation and outsourcing for transactional and routine functions. Some models to consider:

- BOT (Build-Operate-Transfer): Begin operations via a third-party vendor, then gradually transfer ownership and governance to you. This helps reduce risk early while moving toward captive control.

- COPO / Captive + Partner-Operated: Where you maintain ownership but partner with vendors to manage operations (recruitment, compliance, etc.), giving you quicker scale with better control.

- Outsource + GCC Over Time: Use outsourcing to get going quickly; once internal volumes, maturity, or resources reach a threshold, bring those functions in via GCC.

Key Questions CFOs Should Ask in GCCs vs Outsourcing Debate

To decide the right global delivery model, CFOs should ask themselves:

1. What are our strategic priorities for the next 3–5 years?

Are we aiming to innovate, scale, protect IP? Or just optimize cost?

2. How core is the work functionally to our competitive advantage?

If it’s strategic (finance analytics, forecasting, trade/tax compliance, IP), you may need a GCC. If it’s back-office or transactional, outsourcing may suffice.

3. What is our risk tolerance around compliance, data security, cultural alignment, and vendor oversight?

4. What are the total cost implications?

Include upfront investment, ongoing overhead, infrastructure, talent acquisition, vendor fees, long-term quality risk, turnover, etc.

5. How quickly do we need results?

If you need speed (e.g. to respond to regulatory change, or scale operations in a high growth phase), outsourcing offers faster deployment.

6. Do we have internal capabilities to manage a GCC?

To make a GCC successful, you’ll need strong leadership, governance structures, local management, and ongoing capability investment.

7. How will AI, automation, and analytics factors impact the model?

GCCs are more likely to internalize AI platforms, build deep analytics capabilities, and retain control over tech stacks. Outsourcing vendors vary widely in their AI maturity.

How to Mitigate Risks If You Go the GCC Route

If you lean toward GCC, here are risk mitigation steps:

- Ensure robust data protection, cybersecurity, and compliance frameworks.

- Design strong knowledge transfer and retention policies.

- Plan for culture alignment, training, and local leadership.

- Start small with pilot projects or use phased models (BOT, COPO).

- Monitor key metrics: uptime, cost per FTE, quality metrics, innovation or value-added output, employee retention, time to market, compliance incidents.

Consider GCC-as-a-Service

GCC-as-a-Service is an evolved model of the traditional Global Capability Center (GCC) — also known as a Global In-House Center (GIC) — where instead of building, owning, and operating a captive center from scratch, a company partners with a specialized provider to set up and manage the GCC on its behalf.

Think of it as a “plug-and-play” model for global operations.

The provider takes care of:

- Infrastructure, facilities, and technology stack

- Hiring, onboarding, and HR operations

- Compliance, payroll, and local regulatory frameworks

- Continuous improvement, governance, and scaling

Meanwhile, the client company retains strategic control over the processes, priorities, and outcomes — just like they would in a captive setup — but without the high upfront cost or operational risk.

At Datamatics, we’ve long operated in this model and recommend it to clients with highly diverse and specialized needs in the finance and accounting space. Our approach delivers faster time-to-market, accelerated ROI, and measurable cost efficiencies.

Benefits of GCC-as-a-Service:

Faster Time-to-Value:

Traditional GCCs can take 12–24 months to set up; GCCaaS can go live in as little as 3–6 months, leveraging ready infrastructure and local expertise.

Lower Upfront Investment:

No need to commit millions to real estate, tech, and local legal setup. The provider shares operational infrastructure across clients, reducing costs.

Access to Skilled Talent:

Providers have established recruiting networks in talent hubs like India, the Philippines, and Poland, helping companies access specialized F&A, analytics, and tech talent.

Built-in Governance & Compliance:

GCCaaS vendors ensure alignment with global standards (like GDPR, SOC 2, ISO 27001), minimizing regulatory risk.

Scalability & Flexibility:

Scale teams up or down based on project demand — especially valuable for SMBs or mid-market enterprises exploring global expansion without overcommitting.

Innovation-Ready:

Most providers embed automation, analytics, and AI tools into GCC operations, turning them into transformation engines rather than cost centers.

How to Mitigate Risks If You Outsource

If outsourcing seems more viable, be sure to:

- Choose vendors with a strong track record, compliance certifications, and good client references.

- Build SLAs that include innovation, not just task metrics. Include security, IP protection, data access, and audit capabilities.

- Ensure visibility: dashboards, oversight, periodic reviews.

- Keep strategic functions in-house wherever oversight is essential.

- Consider hybridization: split functions so that core, sensitive tasks are closer or onshore, and less risk-sensitive tasks are outsourced.

The Bottom Line: What CFOs Should Do Now in GCCs vs Outsourcing

- Align global delivery model with your vision: Control, innovation, speed, or cost savings?

- Choose partners or build GCCs that match your culture, risk profile, and long-term capability goals.

- Think hybrid and flexible: not “GCC vs outsourcing” but “when does each serve better?”

In volatile times—from rapid tech change, AI, data regulation, to trade/tariff risk—the companies that win will combine operational discipline, strong governance, and strategic global delivery models. GCCs and outsourcing are tools: the right model depends on your scale, your vision, and your willingness to invest in control and quality, as well as cost.

Raajiv Sachdeva