Finance leaders are under pressure to deliver faster closes, reliable forecasts, and real-time insight. Yet most finance functions remain patched together with spreadsheets, manual reviews, and disconnected systems, reminders of a pre-digital era. Finance digital transformation is not about deploying tools. It is about redesigning how data flows, decisions are made, and controls are enforced across the finance function. The difference between improvement and transformation lies in one decision: choosing the right finance outsourcing partner.

A strategic partner does not just execute transactions. They redesign processes, embed intelligence, and enable CFOs to operate with clarity and confidence. This guide outlines how to evaluate providers beyond cost and coverage, and how Datamatics BPM enables real transformation through intelligent finance operations.

Key Takeaways

1. Finance digital transformation succeeds only when process maturity, system intelligence, and disciplined governance are strengthened together—not treated as isolated improvements.

2. A qualified finance outsourcing partner redesigns workflows, embeds automation, and introduces intelligence across P2P, O2C, and R2R rather than just staffing transactional roles.

3. Poorly chosen partners slow transformation through fragmented tools, manual work hidden beneath automation claims, and missing integration strategies.

4. Datamatics BPM delivers transformation architecture, governed cloud operations, AI-driven workflows, and measurable business outcomes—supported by proven expertise, accuracy benchmarks, and compliant delivery frameworks

The Three Pillars of Finance Digital Transformation

A successful CFO digital transformation rests on three fundamentals: process maturity, system intelligence, and operational governance. Addressing only one creates isolated improvement rather than enterprise-level change.

1. Process maturity

Finance process automation only works when workflows are standardized and measurable. Disconnected operations across Procure-to-Pay, Order-to-Cash, and Record-to-Report create errors and rework that even technology cannot fix. A true outsourcing partner identifies process gaps and rebuilds workflows based on efficiency, control, and scalability.

2. System intelligence

AI in finance transformation only delivers value when intelligence is embedded into daily operations. Intelligent finance systems do more than report outcomes. They identify anomalies, automate validations, predict cash flow behaviour, and surface issues before escalation. Systems must reduce dependency on human intervention, not increase it.

3. Operational governance

Automation without discipline creates faster failure. Authority must be defined across data ownership, approvals, exception handling, and compliance rules. A partner must institutionalize controls so accuracy is engineered into every transaction.

A true finance outsourcing partner must strengthen all three pillars. Most vendors focus on staffing. Datamatics BPM focuses on transformation architecture.

7 Ways the Wrong Partner Delays Transformation

Many organizations outsource finance but see limited progress because the partner operates with a volume-delivery mindset rather than a transformation mandate. Common failures include:

- Manual work disguised as automation: Bots address isolated tasks without re-architecting workflows, reducing long-term value.

- Process outsourcing without intelligence: Basic transaction processing is delivered without improvements in insight, forecasting, or control.

- Fragmented technology implementation: Multiple tools are deployed without unified architecture or centralized governance.

- Weak integration strategy: Systems fail to communicate cleanly across ERP, reporting, and analytics platforms.

- Limited AI usage: AI is used in pilot experiments rather than embedded across finance cycles.

- Misaligned KPI ownership: Performance is measured on throughput instead of quality, accuracy, and business impact.

- No roadmap to maturity: Finance functions stagnate in partial transformation without a clear evolution path.

This is where strategic finance outsourcing differs from conventional service delivery.

You can also read: Why Outsourced Accounting Still Matters in the Age of AI and Automation

How Strategic Finance Outsourcing Changes Outcomes

Strategic finance outsourcing improves performance by redesigning finance from the ground up rather than digitizing broken operations.

With the right partner, CFOs gain:

- Faster close cycles: Automation in finance operations removes manual reconciliation and accelerates reporting.

- Reliable insights: Data-driven financial decision-making becomes possible when reporting is built on consistent, governed data.

- Improved forecast accuracy: Predictive models improve confidence in revenue and cash outlook.

- Lower cost structure: End-to-end finance process automation reduces handoffs and rework.

- Greater compliance control: Rule-based governance and audit trails ensure regulatory readiness.

- Scalable operating model: Finance adapts to growth without linear cost increases.

Transformation stops being theoretical and becomes measurable.

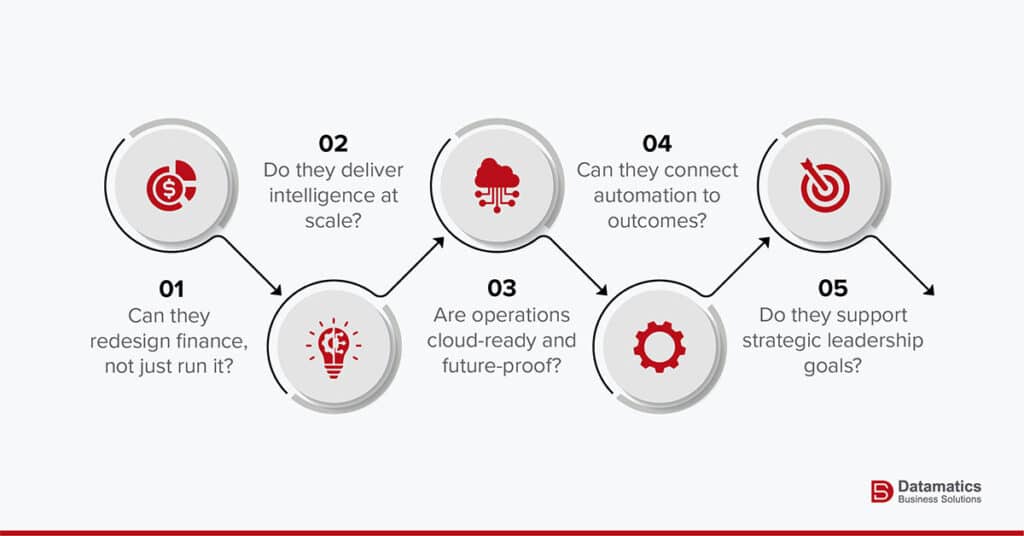

How to Evaluate a Finance Outsourcing Partner: 5 Questions To Ask

Not every provider is equipped for CFO-led transformation. Use the following lens to compare vendors at the decision stage.

1. Can they redesign finance, not just run it?

Transformation starts with architecture. Datamatics identifies bottlenecks, standardizes workflows, and implements automation across finance cycles. It does not automate inefficiency. It eliminates it.

2. Do they deliver intelligence at scale?

With FINATO, Datamatics delivers intelligent finance systems across Procure-to-Pay, Order-to-Cash, Record-to-Report, and FP&A. AI, workflow automation, analytics, and document capture operate as one system rather than siloed tools.

3. Are operations cloud-ready and future-proof?

Cloud-based finance solutions are only effective when governance and integration are built in. Datamatics BPM ensures secure interoperability with ERP and enterprise platforms while enabling real-time insight across operations.

4. Can they connect automation to outcomes?

Automation in isolation delivers limited value. Datamatics BPM correlates automation with speed, accuracy, cost control, and visibility. Every initiative is measured against business impact.

5. Do they support strategic leadership goals?

A digital CFO strategy depends on insight, not just efficiency. Datamatics BPM aligns operational execution to leadership priorities such as cash optimization, risk management, and performance visibility.

You can also read: The Emerging Role of Outsourcing in Sustainability Accounting

Why Datamatics BPM is the Right Finance Outsourcing Partner

Datamatics BPM operates at the intersection of finance transformation, automation, and intelligence. It delivers more than service coverage. It builds finance organizations that scale with confidence.

Clients benefit from:

- Unified finance transformation through FINATO

- Embedded AI in forecasting and reconciliation

- Intelligent automation across core finance cycles

- Cloud-based deployment with built-in governance

- Strategic visibility for CFO leadership

- Measurable gains in productivity and accuracy

Datamatics BPM enables finance to function as a strategic control center, not a transactional unit.

The Bottom Line

Finance transformation fails when outsourcing is treated as a staffing decision. It succeeds when finance is treated as an operating system.

If your function still depends on manual controls, fragmented tools, and delayed visibility, technology alone will not solve the problem. The partner you choose determines whether finance becomes faster or simply more expensive.

Datamatics BPM delivers finance digital transformation through automation, intelligence, and disciplined execution. We help CFOs move from reporting numbers to driving decisions.

When you are ready to build a finance function that is accurate, scalable, and strategic, the conversation changes. And so should your outsourced finance and accounting services partner. To discuss your requirements, get in touch with our team.

FAQs

1. How does the right outsourcing partner accelerate CFO digital transformation?

By redesigning workflows, embedding automation into daily operations, and aligning execution with leadership priorities such as cash control, forecasting accuracy, and performance visibility.

2. What signals indicate that a finance outsourcing partner lacks transformation capability?

Heavy reliance on manual work, fragmented technology deployment, weak integration planning, and measurement focused on volume rather than business impact.

3. Why is transformation architecture more important than tool selection?

Tools improve tasks, but architecture defines how data moves, how controls operate, and how finance scales. Without this, automation simply accelerates inefficient processes.

Harsh Vardhan