2025 was shaped by multiple shocks, not one. Geopolitical tension, tariffs, supply chain shifts, rapid technology change and inflation tested finance leaders throughout the year. 2026 is unlikely to bring much relief.

This environment has exposed pressure points inside finance functions. Planning cycles are struggling to keep pace. Cost control remains critical, but decisions must be made faster and with less certainty.

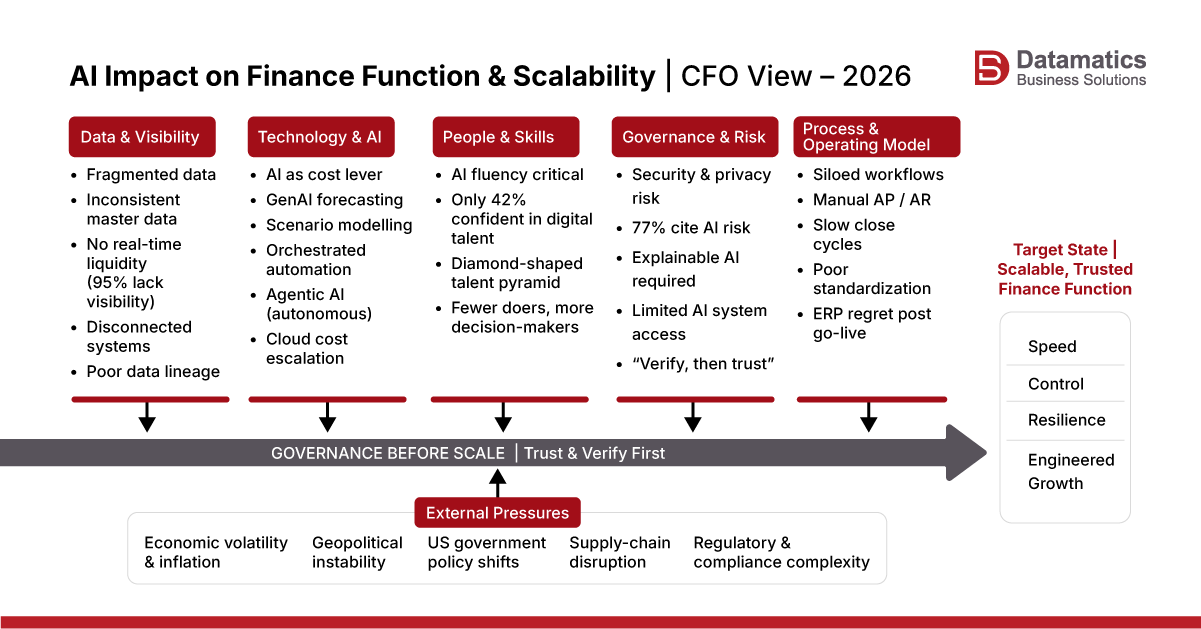

For CFOs, the challenge ahead is clear. Finance must operate under constant volatility while supporting growth and transformation. So, how do you stay ahead despite the turbulence? We’ve prepared a quick, 10-pointer CFO checklist that focuses on scaling finance functions in these adverse times. But, to use the checklist, you must first understand what the scenario looks like and what you are dealing with.

5 Trends (& Takeaways) That Will Change The Financial Landscape in 2026

The following trends explain how the CFO role is changing, and what it will take to scale finance functions in 2026.

Category 1. CFOs are still fixated on costs. But the clock has not slowed down either.

There is a fine but consequential gap between planning and budgeting. But, at a time when decisions must move faster, CFOs remain disproportionately focused on cost. We’re not saying this—the studies are.

Gartner’s latest survey (of more than 200 CFOs) revealed that more than half of CFOs consider enterprise-wide cost optimization among their top five priorities. 14% said it is their top concern.

And findings from the Horváth CFO-Study further validate this pattern: 54% of CFOs are actively initiating cost-cutting programs. In fact, in the US itself, 51% of the CFOs are increasing the cadence of financial reporting, and 45% of them are updating forecasts more frequently.

Cost discipline is becoming a by-product of faster decisions, not the objective itself. In 2026, companies that decide faster will look “leaner” even if they spend more.

Key Takeaway

Cost control still matters, but your role as a CFO is planning, not budgeting. As reporting and forecasting cycles become shorter, CFOs cannot afford to stay anchored in backward-looking budgets.

Category 2. AI’s value lies beyond automation. And CFOs are aware.

AI is a productivity and growth lever, sure. It has certainly redefined every sector from healthcare to e-commerce. In finance, it is viewed as innovative, but adoption remains cautious.

Here’s how the benefits of AI work for finance functions and scalability:

Kyriba’s survey of 1000 CFOs from across the globe identified three trends driving the CFO sentiment:

- CFOs show caution in terms of their confidence in AI solutions.

- Despite the caution, about 96% of the surveyed CFOs and senior leaders are prioritizing in integrating AI into their business operations.

- The focus is more on AI for strategic tasks and driving high-level decision-making

Key Takeaway

By 2030, Gartner expects a significant increase in finance staff with technology and data expertise. But the real shift is not AI replacing finance work, but AI reshaping how finance work is distributed. As AI moves into strategic tasks, the CFO role itself becomes less about review and more about arbitration.

You can also read: The CFO’s Guide to Credit Risk Management

Category 3: The finance function is being redesigned for volatility.

Volatility is no longer an external factor for finance teams to monitor. It is now a condition they are expected to operate within.

Recent findings from The CFO Survey, conducted by Duke University Fuqua School of Business with the Federal Reserve Bank of Richmond and Federal Reserve Bank of Atlanta, show that tariffs and policy uncertainty remain top CFO concerns.

Rather than reacting with aggressive cost cuts or expansion, CFOs are reshaping how finance operates: prices are expected to rise 3.5% in 2026, growth remains modest, and hiring plans are cautious.

In response, finance leaders are prioritizing digitalization, automation and scenario analysis, supported by cost controls and liquidity buffers.

Category 4: AI investment now demands CFO ownership

AI investment can no longer sit solely with technology or product leaders. What began as innovation-led spend has become capital-intensive, long-term and financially consequential—placing it firmly within the CFO’s remit.

Recent market behaviour shows how quickly AI narratives are being tested against earnings. Valuation swings around companies such as Nvidia reflect a broader shift: AI investments are now judged on execution and returns, not vision alone. Mixed signals across peers, including Alphabet and AMD, reinforce this.

For CFOs, this reshapes oversight. AI spend is cross-functional, capital-intensive and uncertain in payback, making it a finance issue that demands tighter controls, clearer accountability and integration into enterprise planning.

Key Takeaway

AI is no longer a budget line to be approved. It is an economic system to be owned. CFOs who take direct ownership of AI economics will be better positioned to balance ambition with discipline as scrutiny intensifies.

You can also read: How CFOs Are Using Finance & Accounting Outsourcing to Drive Growth, Not Just Cost-Cutting

Category 5. Finance transformation is stalling—not for lack of spend, but for lack of capacity

Despite sustained investment, finance transformation remains incomplete across many organizations. The constraint is no longer the budget. It is human bandwidth.

The data points to familiar blockers—silos, weak change management, skills gaps and investment hesitation. Even as over 70% of finance leaders plan ERP migrations, post–go-live regret remains common, signalling that complexity is rising faster than clarity.

AI has added to this strain. Rather than simplifying finance, it has introduced more systems, vendors and governance, increasing the cognitive load on already stretched teams.

Key Takeaway

For CFOs in 2026, progress will come from simplification—fewer systems, clearer ownership and better-connected decision surfaces. The next phase of finance transformation will be driven by subtraction, not addition.

Ready for What’s Ahead? The 10-Pointer CFO Checklist For Scaling Finance Functions in 2026

Based on the trends we assessed, here’s a 10-pointer physical as well as virtual CFO checklist to scale finance functions and operations in 2026:

- Shorten decision cycles: Measure and reduce the time it takes for finance to move from insight to decision, not just from close to report.

- Replace annual budgets with rolling plans: Shift from fixed annual budgets to rolling forecasts that update assumptions and trigger action throughout the year.

- Increase forecast frequency without adding workload: Refresh forecasts more often, but standardize inputs and assumptions so speed does not come at the cost of burnout.

- Use AI where judgement is required: Apply AI to forecasting, scenario modelling and decision support, not just transactional automation.

- Redesign finance roles around decision ownership: Move finance leaders away from review-heavy roles toward clear ownership of pricing, margin and capital decisions.

- Plan for multiple futures by default: Make scenario planning standard practice so the business is not anchored to a single version of the future.

- Embed macro and policy risk into core models: Treat tariffs, regulation and inflation as planning inputs, not external assumptions reviewed after the fact.

- Take ownership of AI economics: Bring AI investment under CFO control with clear return expectations, payback logic and ongoing performance review.

- Apply capital discipline to AI spend: Fund AI initiatives in stages and reassess them like any other long-term investment when outcomes lag expectations.

- Scale by removing complexity: Actively reduce systems, reports and approvals so finance teams spend more time deciding and less time reconciling.

Final Words

In 2026, decisiveness is a key enabler. Refer to the 10-pointer CFO checklist to manage financial aspects of AI and simply financial processes in a time of higher volatility. In addition to the above, spending less time on manual and redundant tasks will also give you a vantage point. Here, let Datamatics do the heavy lifting. By outsourcing important finance and accounting tasks, you focus on what matters the most—scaling finance functions and moving your team ahead despite turbulent times.

Let Datamatics BPM be your support engine. Get in touch with us today.

FAQs

1. Why is cost control not the main constraint for CFOs today?

Most companies are already operating under cost discipline. The real constraint is the slow speed of decision-making, which hinders growth, price changes and capital allocation.

2. How should CFOs get started with adopting AI in finance?

CFOs should first consider how AI can enhance their ability to make judgment calls when forecasting, modelling scenarios and analyzing trade-offs, rather than concentrating on the automation of transactional finance functions.

3. What does the concept of "designing for volatility" mean?

Designing for volatility means always planning with multiple scenarios in mind, integrating macro-risks into financial models, and not relying on one single, stable forecast or economic model to be the basis for financial decision-making.

4. Why does the CFO need to own the investment in AI?

Investment in AI will require a higher level of capital investment, is long-term in nature, and it crosses multiple functional areas of an organization; therefore, with no CFO ownership of the AI initiative, it is likely the organization will misallocate capital to AI initiatives and fail to connect AI initiatives with financial results.

Harsh Vardhan