For growing small and mid-sized businesses (SMBs), financial leadership often arrives just in time — but not always full-time, and they come in the form of fractional CFO services. But it is not just small businesses that see this model of C-suite roles appealing. Many larger companies undergoing critical transitions like mergers, IPO, or strategic pivots also tap into fractional leaders with niche expertise.

Whether it’s preparing for funding, improving cash flow visibility, or tightening financial reporting, a fractional CFO brings the strategic clarity and control that early-stage and scaling companies need — without the cost of a full-time executive. But success doesn’t happen by chance. The first 90 days are critical for setting expectations, aligning priorities, and building momentum. This is where the foundation for trust, transformation, and measurable results is laid.

Here’s your detailed roadmap for the first three months of working with a fractional CFO — what to expect, what to prioritize, and how to ensure your finance function becomes a true business enabler.

Key Takeaways

- The first 90 days set the tone — A fractional CFO engagement isn’t just a short-term plug-in; the first three months are critical to build trust, align strategy and establish credibility with leadership and investors.

- Month 1 is about discovery & diagnostics — This phase involves deep dives into business model (revenue streams, cost drivers), financial health (income statement, cash-flow, forecasting gaps), and systems/platforms to map “where we are” and “where we need to go”.

- Month 2 focuses on systems, structure & governance — After diagnosis, the fractional CFO works on process improvements (automation, standardisation), strengthening controls (vendor diligence, audit readiness), and aligning finance strategy with business strategy.

- Month 3 moves into execution, insights & investor readiness — With foundations in place, the work shifts to rolling forecasts, scenario planning (e.g., fundraising, expansion), building investor confidence through clean books, and embedding performance & accountability via KPIs.

- Success comes from measuring results and building the next phase — Tracking metrics like days to close, error rates, automation time savings, audit readiness, and cash-flow improvements is essential. Also key is deciding what happens after the initial 90 days: ongoing strategic CFO support, outsourcing, or building in-house.

Why the First 90 Days Matter

Bringing in fractional CFO services isn’t like hiring an accountant or a controller. You’re bringing in a strategic partner — someone who needs to understand your business model, challenges, and goals to deliver meaningful outcomes.

Working with fractional CFO services does not mean that your entire finance and accounts department needs an overhaul. The fractional CFO is a seasoned professional with decades of experience delivering financial leadership, strategic guidance, and analytical support to companies, both large and small. They work alongside your existing team, whether it is just a bookkeeper, or a full-fledged team with a controller and finance leader, and act as a strategic layer ensuring guidance, oversight and accurate insights.

The early phase determines how quickly the CFO can move from diagnosis to impact. It’s when they:

- Establish credibility with leadership and investors

- Identify gaps in financial visibility and controls

- Prioritize key opportunities for improvement

- Align the finance strategy with the growth strategy

Without structure in this period, businesses risk confusion, missed opportunities, and misaligned expectations.

Month 1: Discovery and Financial Diagnostics

The fractional CFO will not be able to deliver right from the word go, but they will build a solid foundation to achieve sustainable, measurable, and scalable growth in the coming months. A proper understanding and assessment of the current state are essential to arrive at the to-be state that the CFO wants to take the organization to. This understanding or discovery phase realizes with a deep dive into the business model—how it makes money, what drives costs, and where value leaks.

They’ll dig into:

- Revenue streams, pricing models, and customer acquisition costs

- Core products or services and their profitability

- Key business risks, dependencies, and market dynamics

The goal is to gain a 360° view of both financial and operational performance drivers.

Next, your existing numbers and systems will also be analyzed as part of the financial health assessment. This diagnostic phase often includes:

- Reviewing income statements, balance sheets, and cash flow statements

- Identifying gaps in forecasting, reporting, and controls

- Assessing accounting accuracy, compliance, and data integrity

- Reviewing current finance tech stack (ERP, accounting software, Excel workflows, etc.)

You can expect a financial health report or analysis that highlights inefficiencies, risks, and areas needing immediate attention.

A roadmap to the future

Armed with insights from the diagnostic phase, the fractional CFO creates the roadmap or financial playbook that ties financial strategy to business goals.

This may include:

- Setting up short- and long-term KPIs

- Designing dashboards for financial visibility

- Outlining a 13-week cash flow forecast

- Establishing budget vs. actual variance tracking

The playbook acts as the foundation for decision-making and accountability.

Stakeholder alignment

In parallel, the fractional CFO will engage with the CEO, founders, investors, department heads, and accounting team. These discussions clarify:

- Strategic priorities and growth objectives

- Current challenges (cash crunch, margin pressure, investor reporting, etc.)

- Expectations for communication and deliverables

By the end of Month 1, your CFO should have a clear understanding of “where we are” and “where we need to go.”

Many fractional CFOs offer the first phase, or the diagnostic phase, at a nominal fee. This allows fractional CFO services to prove their value by identifying major gaps and charting a roadmap to remove inefficiencies and unlock value. During the deep dive phase, business owners can recognize the real potential of working with an experienced, qualified finance leader who can deliver the results they are looking for.

You can also read: The Emerging Role of Outsourcing in Sustainability Accounting

Month 2: Strategy, Systems, and Structure

Process Improvement

Most SMBs operate with lean finance teams, often juggling multiple roles and manual processes.

The CFO identifies areas for automation and standardization:

- Automating accounts payable (AP) and accounts receivable (AR)

- Introducing closing checklists and workflow systems

- Reducing spreadsheet dependency

- Implementing cloud-based accounting tools and dashboards

This streamlining ensures faster closes, fewer errors, and improved visibility across functions.

Governance and controls

Strengthening governance and controls is another key area of focus in Month 2.

As companies scale, governance becomes critical. One of the initial activities of the fractional CFO is establishing a strong foundation for a compliant organization. This includes helping the business leaders understand the importance of building a ‘risk-aware’ culture, establishing a strong risk management framework, and optimizing technology to increase transparency and control.

The CFO establishes internal controls to prevent leakage and compliance issues:

- Expense approval hierarchies

- Vendor due diligence and procurement controls

- Audit readiness and documentation standards

- Data security and segregation of duties

This isn’t bureaucracy — it’s risk management for growth. The fractional CFO ensures that risk management is not seen as merely a compliance exercise, but rather as a strategic enabler of sustainable development.

Strategic alignment

Fractional CFOs are not just number crunchers; they’re strategy partners. Hence, one of the earliest moves they make is to align finance with strategy.

When you hire a fractional CFO, you will see that they prioritize integrating into your team and winning their confidence. No leader can succeed in isolation, and your fractional CFO recognizes this well. They are able to facilitate collaboration across teams, collate data, and align efforts and output from all departments, including sales, operations, HR, marketing, etc.

They help leadership answer key questions:

- Which revenue streams are most profitable?

- Are we pricing products correctly?

- Do we have enough runway to sustain growth or to raise capital?

- How can we model different growth scenarios?

By the end of Month 2, the financial strategy starts to align closely with the business strategy — and decisions become data-driven rather than intuition-based.

Month 3: Execution, Insights, and Investor Readiness

Planning and forecasting

Now that systems and processes are stabilized, the CFO turns attention to forward-looking insights.

They’ll develop rolling forecasts and “what-if” models to simulate:

- Changes in sales volume or pricing

- Hiring plans and OPEX adjustments

- Market or interest rate shifts

- Expansion or fundraising scenarios

This enables leadership to see the future before it happens — and make proactive moves.

Fractional CFO services have strong expertise in providing financial planning and forecasting support, and identify it as a crucial value enabler for small and growing businesses to achieve sustainable progress.

Building Investor Confidence

For startups and growth-stage companies, investor communication is key.

A fractional CFO ensures you can present credible, defensible financials:

- Clean books and reconciled statements

- Data-backed projections

- Metrics investors care about (burn rate, CAC/LTV, runway, etc.)

- Cohesive narratives that align with your funding story

The goal is not just to raise funds — but to build lasting investor trust through transparency and consistency.

Driving Performance and Accountability

By Month 3, the CFO moves from setup to acceleration:

- Monthly financial review meetings with leadership

- Departmental KPI reviews tied to budget and forecasts

- Recommendations for cost control or growth investments

- Early identification of variances and corrective actions

This creates a culture of accountability and continuous improvement within the finance function.

Planning the Next Phase

Finally, the fractional CFO helps the organization look beyond the initial engagement:

- Is there a need for ongoing strategic support?

- Should certain functions be automated or outsourced?

- Is it time to build an in-house finance team?

A clear next-phase plan ensures sustainability and smooth transitions as the business grows.

Thus, with the right blend of strategic insight, operational discipline, and collaborative execution, your fractional CFO can transform financial management from reactive to predictive — and set your business up for sustainable success, with solid value-addition in the first 90 days.

You can also read: AI in Accounting Explained: Benefits, Applications, and Improvements

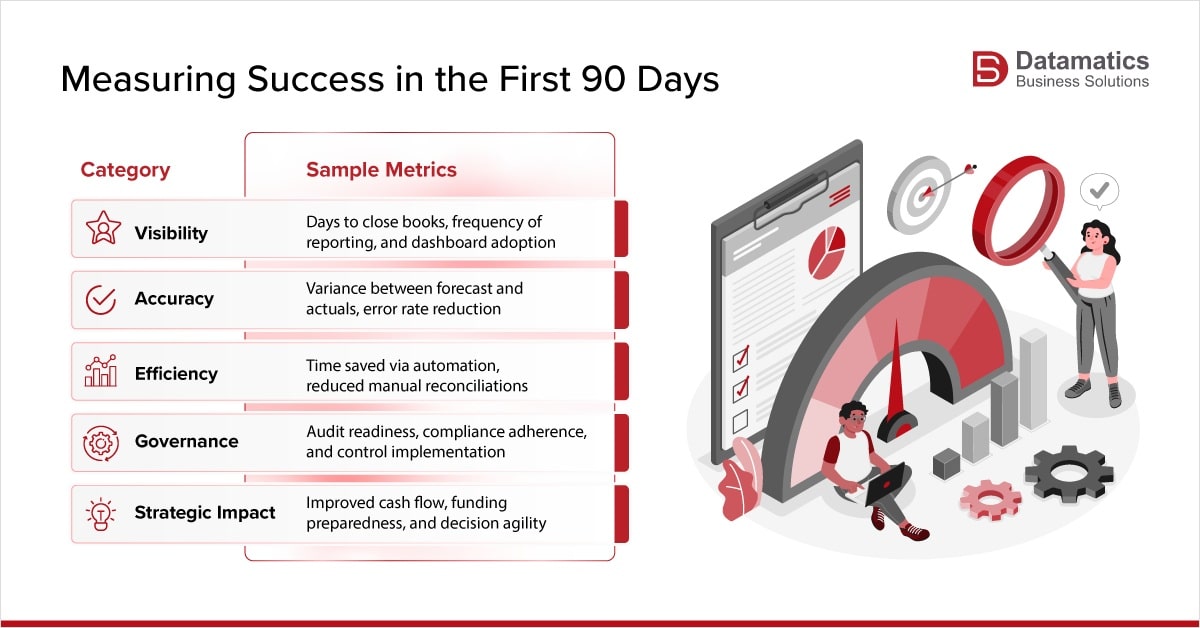

What’s Next? Measuring Success in the First 90 Days

To ensure your investment in fractional CFO services delivers value, track success through a mix of quantitative and qualitative metrics (though some of these metrics may have a longer timeline beyond the first 90 days):

When done right, you’ll see the shift — from reactive financial management to proactive financial leadership.

How Outsourced Accounting Teams Amplify Fractional CFOs

Many fractional CFOs partner with outsourced finance and accounting teams to execute day-to-day tasks like bookkeeping, AP/AR management, and reconciliations.

This combination allows:

- The CFO to focus on strategy, forecasting, and performance

- The outsourced team to handle accuracy, timeliness, and scalability

It’s a win-win for SMBs — blending executive oversight with operational efficiency.

Conclusion

The first 90 days of fractional CFO services aren’t just an onboarding phase — they’re a launchpad for financial maturity. A successful start ensures that finance becomes not just a function, but a strategic growth partner — capable of steering the business through uncertainty, funding, and scale.

FAQs

1. What exactly are fractional CFO services?

A fractional CFO provides part-time or interim CFO leadership—strategic financial oversight, forecasting, controls, and investor relations—without the cost of a full-time executive.

2. How soon should I expect to see value from fractional CFO services?

While full transformation takes longer, meaningful value begins in the first 90 days through diagnostic findings, better visibility, aligned strategy and strengthened controls—as the roadmap details.

3. What size of company typically benefits from fractional CFO services?

Growing small-to-mid-sized businesses (SMBs), companies preparing for funding or strategic transitions, and enterprises needing CFO expertise without full-time hire are ideal candidates.

4. How do fractional CFO services differ from outsourcing accounting or bookkeeping?

Bookkeeping and accounting handle day-to-day transactions; fractional CFO services focus on strategic leadership—forecasting, investor readiness, aligning finance with growth strategy—and often partner with accounting/outsource teams for operational execution.

5.What should a business track to measure the success of a fractional CFO engagement?

Key metrics include: reduction in days to close the books, improvement in forecast versus actual accuracy, time saved via automation, stronger governance/audit readiness, and strategic outcomes such as improved cash flow or successful fundraising.

Harsh Vardhan