The future of mobility for next-generation EV battery technologies is at the crossroads of innovation and opportunity. With the rapid evolution of the electric vehicle (EV) landscape, driven by global demands for sustainability and efficiency, next-generation EV batteries stand out as the pivotal technology reshaping the future of mobility. According to recent studies, the global EV battery market is projected to reach $81.41 billion by 2025 and $299.6 billion by 2035, growing at a 14.1% CAGR.

For the players in this space, you need to capitalize on these advancements to fuel your business growth. In the Asia-Pacific region, China’s dominance in production, accounting for over 70% of global EV batteries, has helped it capture a 40% market share, highlighting regional disparities. Meanwhile, Europe’s focus on local manufacturing aims to close the gap.

The limitations of the current system can be considered a catalyst for the monumental rise in EV adoption. Globally, EV sales hit 14 million in 2023, with battery demand expected to climb from 1,970 GWh in 2025 to 3,910 GWh by 2030. In North America, incentives such as the U.S. Inflation Reduction Act are boosting domestic production; yet, imports from China still meet over 30% of the needs.

As the strategic growth consultant to several global leaders in the next-gen EV battery technologies, we regularly share our insights with our clients to help them position their strategies ahead of the curve. If you’re interested in the next-gen EV battery space, this blog will provide a glimpse into the challenges and opportunities that can fuel your business growth.

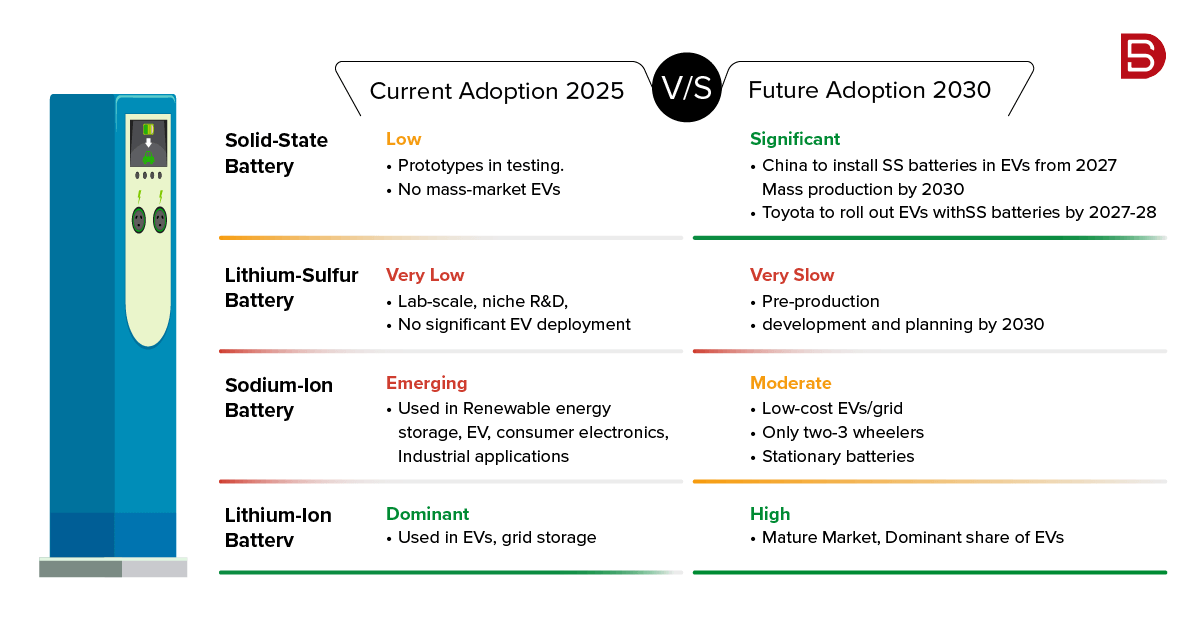

How does today’s lithium-ion battery stack up against emerging options for next generation EV batteries?

Lithium-ion batteries are the workhorses of today’s EVs; they are mature, scalable, and supported by a huge supply chain. A typical Li-ion battery pack in an EV delivers nearly 150–265 Wh/kg at the cell level, depending on the chemistry (NMC, NCA, LFP) and packaging, which makes them reliable, faster to develop, and supported by decades of production learning.

However, the over-reliance on constrained raw materials (such as nickel and cobalt) and incremental energy-density gains limits their capability. This is why the modern EV industry is significantly investing in next-generation EV batteries such as solid-state, sodium-ion, and lithium-sulfur to break the trade-offs between cost, safety, and range.

Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel.Why Are Current Lithium-Ion Batteries Reaching Their Limits?

Lithium-ion batteries dominate the current EV landscape, and that technology is becoming increasingly apparent. While still revolutionary, these batteries have critical limitations that impact customer satisfaction and market positioning. The energy density for these batteries generally caps at 250-300 Wh/kg, which creates range anxiety and consequently impacts the adoption rates across global markets.

Furthermore, the lithium-ion battery market is also impacted by supply chain vulnerabilities, with 70% of global lithium reserves concentrated in just three countries: Chile, Australia, and Argentina. It creates pricing volatility, which can have a direct impact on your profit margins and product competitiveness. Moreover, the ethical sourcing challenges of cobalt also put the industry under scrutiny in front of consumers.

Further complicating the deployment of lithium-ion batteries is the issue of thermal management and safety concerns. Especially in geographical areas that experience extreme weather conditions. Modern customers demand extreme reliability, but current Li-ion battery technologies experience severe performance degradation in temperatures below 10°C or above 50°C, which makes it challenging to penetrate regions such as Scandinavia or the Middle East.

The manufacturing costs for these battery packs remain a significant component of the overall EV production cost, accounting for nearly 30-40% of the entire production cost. This economic constraint significantly hampers the ability to mass market pricing while maintaining healthy margins, especially as competition intensifies across all vehicle segments.

Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel.What are the leading next generation EV batteries you need to track?

As an EV automotive maker, you need to closely track three key categories: sodium-ion battery, solid-state battery, and lithium-sulphur battery developments. Each of these battery technologies addresses a different business question, such as cost and resource diversification (sodium), safety and energy density (solid-state), or ultra-lightweight high energy (Li-S).

What advantages and challenges do sodium-ion batteries present for next-generation EV batteries?

Sodium, compared to lithium, is cheaper and more abundant. It makes sodium-ion batteries the logical route to lower pack costs and regional supply independence, especially if you are in a market where the lithium supply chain is limited.

The current generation of sodium-ion cells is achieving energy densities in the ~100–160 Wh/kg range, with vendors such as CATL and Faradion rapidly scaling their production lines and conducting testing pilots. The key challenges slowing the adoption of sodium-ion batteries include their low energy density, which makes them more suited for entry-level EVs, two-wheelers, and stationary storage, rather than long-range, premium EVs. For cost-sensitive segments, sodium-ion batteries are expected to play a significant role in regions such as China, India, and parts of Europe.

You can also read: Top 7 Cleantech Sectors to Watch in 2025

Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel.How will solid-state batteries change the next generation EV batteries landscape?

Here are the practical energy-density numbers for you to compare the next-generation EV batteries:

- Lithium-ion: ~150–265 Wh/kg practical cell energy.

- Sodium-ion: ~100–160 Wh/kg today

- Solid-state: ~20–40% over modern Li-ion cells in some tests; theoretical potential is higher.

- Lithium-sulfur: ~500–2,600 Wh/kg (theoretically

While some of these numbers are theoretical, you can use them as a guiding light when modeling cost, range, and thermal management for product roadmaps.

Who are the key players you should watch in each next generation EV batteries category? -

If you are looking to forge partnerships and competitive intelligence in the EV battery space, you must map players by technology:

- Sodium-ion battery: CATL (with large-scale plans), Faradion, HiNa, and Altris; these players are strong regionally in Asia and are expanding globally.

- Solid-state: QuantumScape, Solid Power, Toyota, Samsung SDI, Factorial Energy, and OEM integrators like Mercedes in demonstrators. These are the players that are likely to shape the EV strategies for the premium segment.

- Lithium-sulphur battery: Sion Power, Zeta Energy partnerships with OEMs, start-ups such as Lyten, and OEM collaborations (e.g., Stellantis). We can also expect larger players, such as LG and others, to make a foray into the space through strategic acquisitions or joint ventures.

- Lithium-ion incumbents (still critical): CATL, BYD, LG Energy Solution, Panasonic. Their product segmentation and roadmaps will be critical in shaping how and when the new technology displaces mandatory chemistries.

Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel.Where will different next generation EV batteries gain fastest traction?

Knowing where the next-generation EV batteries will gain faster traction will help you formulate your regional strategy. Here are some regional insights to help you get started:

China: The rapid deployment of sodium-ion batteries and sustained Li-ion volume establishes them as regional leaders, with players like CATL. You can expect them to offer strong early commercial experiments and quick scaling.

Europe & North America: Driven by significant investment in solid-state and Li-S pilot projects, OEMs in this region will capitalize on domestic supply chains and lighter vehicles for long-range models. There will also be significant policy incentives for domestic manufacturing, which will accelerate this trend.

India & Southeast Asia: Driven by lowered cost and significant thermal resistance, the India and Southeast Asia region will experience significant improvement in sodium-ion and LFP (lithium iron phosphate) chemistries; the key factors here will be localized manufacturing and affordability.

What strategic research should you commission to win in next generation EV batteries?

If you are planning to ride the next-generation EV battery wave, you must commission custom research that combines:

- Go-to-market scenario planning by vehicle segment.

- Market Opportunity & Demand-Side Signals

a. Adoption Scenarios by Region & Segment

- Entry-level EVs (Asia, cost-sensitive markets) → Sodium-ion

- Premium EVs (US, Europe, Japan) → Solid-state, Lithium-sulfur

- Commercial fleets & buses: Lithium-ion/solid-state hybrids

b. Consumer Preference Shifts

- Range anxiety vs. cost sensitivity

- Charging time tolerance across markets

c. Total Addressable Market (TAM) Evolution

- Forecast EV sales by battery chemistry, 2025–2035

- Growth in stationary storage crossover applications

3. Supply-Side & Value Chain Mapping

a.Critical Minerals & Raw Material Access

- Lithium vs. sodium sourcing geographies

- Cobalt-free and rare-earth independence opportunities

b.Supply Chain Resilience

- Regional vulnerability mapping (China, India, EU, US policies)

- Impact of geopolitical risks on rare material access

c. OEM & Cell Maker Alliances

- Which automakers are betting on which chemistries?

- Partnership structures (e.g., Toyota–QuantumScape, CATL–OEMs)

4. Competitive Intelligence

a. Benchmarking Key Players

- Startups: Faradion, QuantumScape, Solid Power, SES

- Giants: CATL, LG Energy Solution, Samsung SDI, Panasonic, Toyota

b. Patent & IP Landscape

- Innovation clusters in sodium-ion vs solid-state

- Licensing opportunities & litigation risks

c. M&A & Funding Trends

- Venture flows in solid-state & Li-sulfur

- Strategic acquisitions shaping market dominance

This research framework will help you transform uncertain science into actionable investment thresholds and partnership checklists.

Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel.Conclusion — what should you do next?

The next-generation EV batteries will usher in a staggered revolution; you will need data-driven insights tailored to individual sectors, not just generic blanket information. Collaborating with a focused, custom research provider will help you map the cost curves, regional policies and their impacts, supplier readiness, and pilot KPIs, enabling you to transform next-generation EV batteries from a speculative tech bet into a strategic growth lever. If you are looking for tailored custom research focused on next-gen EV battery technologies, write to us at marketing@datamaticsbpm.com, and we will have our research experts reach out to you with a solution perfectly tailored to meet your business needs.

Somnath Banerjee